a-jrf.ru

Categories

What Days Of The Week Are Best To Book Flights

The magic of Tuesday (or not) Ask anyone the best day of the week for booking flights and they will probably say Tuesday. Is this actually true or an urban. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. A study of domestic flight pricing reveals you'll want to book your flight between four months and three weeks before your domestic trip. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. Flying any time near a big holiday such as Thanksgiving or Christmas will be busy, and travel during Spring Break can also be hectic in some popular areas. The. For instance, according to Expedia's Travel Hacks Report, Sunday is the best day of the week to find cheaper flights—and has been for the past 5 years The best day to book flights is whatever day a deal pops up. While that may be on a Tuesday, it may also be on any other day of the week. Luckily, modern. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. The magic of Tuesday (or not) Ask anyone the best day of the week for booking flights and they will probably say Tuesday. Is this actually true or an urban. Airfares offered on Thursdays tend to be the cheapest, according to flight demand on Travelocity in Tuesday and Wednesday prices are also good. A study of domestic flight pricing reveals you'll want to book your flight between four months and three weeks before your domestic trip. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. Flying any time near a big holiday such as Thanksgiving or Christmas will be busy, and travel during Spring Break can also be hectic in some popular areas. The. For instance, according to Expedia's Travel Hacks Report, Sunday is the best day of the week to find cheaper flights—and has been for the past 5 years The best day to book flights is whatever day a deal pops up. While that may be on a Tuesday, it may also be on any other day of the week. Luckily, modern. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights.

According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what. The magic of Tuesday (or not) Ask anyone the best day of the week for booking flights and they will probably say Tuesday. Is this actually true or an urban. You can even check for flights departing today. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a. Studies show that the cheapest time to book is 49 days before your departure, or 81 days ahead of time for international flights. Interestingly, flights booked. What is the most affordable day of the week to travel? You may not get cheaper airfare by booking on a specific day, but when you plan on flying can affect. Days of the week. Tuesdays, Wednesdays, and Thursdays are often the cheapest days to fly, as fewer people travel mid-week. Avoid booking flights that depart. Note: You can consider booking your flights on mid days of the week like Tuesdays and Wednesdays (best days to buy flights). Specifically, Tuesday is considered. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. For international flights, the best prices are typically available from two to eight months in advance. Sponsored Bank Accounts. Which day of the week is the best day to buy cheap flight tickets? The cheapest day to buy plane tickets is Sunday, which offers savings of around 10% on. According to experts, the best day of the week to book a flight is said to be a Tuesday. This is because most airlines release their weekly sale prices on. Yes, flights are often cheaper when booked on weekdays, particularly Tuesdays and Wednesdays. Additionally, flying on less popular days like. A study of domestic flight pricing reveals you'll want to book your flight between four months and three weeks before your domestic trip. According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what. However, Hopper have discovered that amongst the 7, popular domestic flight routes we isolated for this study, Thursday is actually the cheapest day to book. What is the most affordable day of the week to travel? You may not get cheaper airfare by booking on a specific day, but when you plan on flying can affect. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. While the most expensive tickets tend to be booked on Tuesdays and Fridays, you can save more by booking your flight on a Sunday. 8. Choose the best days to. According to experts, the best day of the week to book a flight is said to be a Tuesday. This is because most airlines release their weekly sale prices on. Flying midweek or on Saturdays generally yields lower fare prices while Sundays, Fridays, and Mondays can be expensive flying days. At the airport, visit the.

How To Use The Credit Card

Credit cards work by issuing you a line of credit that you can use to make purchases. You are then required to pay back the loan — ideally in full at the end of. How does a credit card work? · You swipe, insert or tap your card at the card reader when checking out. · The merchant contacts your credit card issuer through. 10 tips for responsible credit card usage · 1. Read your card agreement and know your terms · 2. Be aware of potential fees · 3. Make payments on time · 4. Pay. How do credit card payments work? Every month you'll receive a statement showing the minimum payment you'll need to pay for the month and your due date. The. How to pay with a credit card online · Check the website is secure. · Select your item(s). · Go to the “checkout”. · Enter your details. · Choose “credit card”. How does a credit card work? · You swipe, insert or tap your card at the card reader when checking out. · The merchant contacts your credit card issuer through. Key Takeaways · Credit cards are plastic or metal cards used to pay for items or services using credit. · Credit cards charge interest on the money spent. · Credit. Credit cards are a great way to avoid applying for a loan if you need to borrow some money for a short amount of time. Because a credit card is a rotating. A credit card lets you spend up to an agreed amount, called your credit limit. The exact amount will depend on things like your credit history and income. Each. Credit cards work by issuing you a line of credit that you can use to make purchases. You are then required to pay back the loan — ideally in full at the end of. How does a credit card work? · You swipe, insert or tap your card at the card reader when checking out. · The merchant contacts your credit card issuer through. 10 tips for responsible credit card usage · 1. Read your card agreement and know your terms · 2. Be aware of potential fees · 3. Make payments on time · 4. Pay. How do credit card payments work? Every month you'll receive a statement showing the minimum payment you'll need to pay for the month and your due date. The. How to pay with a credit card online · Check the website is secure. · Select your item(s). · Go to the “checkout”. · Enter your details. · Choose “credit card”. How does a credit card work? · You swipe, insert or tap your card at the card reader when checking out. · The merchant contacts your credit card issuer through. Key Takeaways · Credit cards are plastic or metal cards used to pay for items or services using credit. · Credit cards charge interest on the money spent. · Credit. Credit cards are a great way to avoid applying for a loan if you need to borrow some money for a short amount of time. Because a credit card is a rotating. A credit card lets you spend up to an agreed amount, called your credit limit. The exact amount will depend on things like your credit history and income. Each.

Every time you pay with a credit card, you borrow from your card provider to make that payment. It's up to you whether you pay off your statement balance in. How & when to use your credit card · Pay your credit card balance on time · Pay as much of your credit card balance as you can afford each month · Use your. The CareCredit credit card is a simple, flexible way to pay for a wide range of health and wellness wants and needs for you, your family, and your pets. See if. When you use a debit card as credit, you are not "borrowing" money and then repaying it later, as with a credit card. Instead, the entire transaction amount is. Find everything you need to know about credit cards, including pros and cons, how they work, how to apply and how to find the best credit card for you. Yet rather than taking money from your account each time you spend, the credit card company pays and sends you a bill for it all each month. If you pay this off. Credit cards can help strengthen credit, while earning rewards for everyday purchases. They also give you the flexibility to pay back purchases over time. How do credit card payments work? Card issuers send their customers a monthly credit card statement through the mail or electronically. Statements include. 5 Best Practices for Using a Credit Card · 1. Pay your balance to $0 each month, if possible. · 2. Keep your credit utilization (percentage of outstanding. How do I use credit? When you use credit, it usually means using a credit card. It also might mean that you get a loan. A loan is another way to use credit. Unlike debit cards, credit cards can be used to improve your credit score. A credit card issuer will report each monthly payment that you make to the three. 6 Smart Ways to Use a Credit Card · 1. Understand How Interest Works · 2. Use Your Credit Card to Build Credit · 3. Earn Cashback Rewards on Your Purchases · 4. Smart Ways To Use Your Credit Card · 1. Keep an eye on your spending · 2. Set an ideal credit limit · 3. Check Credit Card statements regularly · 4. Use free. A credit card can be used to pay for new purchases by swiping, tapping or inserting your card into a payment terminal, or entering your account info online. You. If you pay your balance in full each month, there's often no cost to you for using the card. If you carry a balance from month to month, you'll pay interest. Will paying by card or digital wallet work for you? · You can pay online or over the phone (see Payment Processor contact information below for phone payments). Always note the amount due and the payment date so you pay on time, every time. · Read the contract with your card issuer so you understand the terms and. When used correctly, credit cards are a useful tool to build credit. Each month, credit card companies report on consumer payments to the credit bureaus. If you. A credit card is a great way to start building up your credit, which is especially important for international students who do not have credit history in the US. 12 Tips to Use a Credit Card but Not End Up in Debt · 1. Save Up for Purchases · 2. Prepay Your Credit Card With Every Pay Cheque · 3. Use Your Credit Card for.

What Happens When You Invest In A Startup

RISKS ASSOCIATED WITH INVESTING IN STARTUPS · Most startups fail · Exits take time. Overview of our portfolio exits. · Startup investments are illiquid. When you'. Startup owners generally want to raise significant funds, and that too, fast. However, finding someone willing to invest in your business, even if you find. Startup investing is the process of investors buying shares in early stage companies. It differs from traditional stock market investing. In exchange for a lump sum of cash, these investors receive equity in the business that they can sell (hopefully for more than their initial investment) at a. Get equity and front row seats to the startups and small businesses you love—for as little as $ Angel investors offer a personal touch to the startup funding process. They often take a proactive, interested role in making your company a success. With the. Startup investors make money by selling their shares in a company at a higher share price than they paid for them. After the initial round of seed funding, many startups grow (or fail) without any further investments. Startups give away a chunk of their equity, and they get. Startups agree to pay the total of the loan back to the investor, along with all interest accrued at a fixed rate, over time. While debt investments typically. RISKS ASSOCIATED WITH INVESTING IN STARTUPS · Most startups fail · Exits take time. Overview of our portfolio exits. · Startup investments are illiquid. When you'. Startup owners generally want to raise significant funds, and that too, fast. However, finding someone willing to invest in your business, even if you find. Startup investing is the process of investors buying shares in early stage companies. It differs from traditional stock market investing. In exchange for a lump sum of cash, these investors receive equity in the business that they can sell (hopefully for more than their initial investment) at a. Get equity and front row seats to the startups and small businesses you love—for as little as $ Angel investors offer a personal touch to the startup funding process. They often take a proactive, interested role in making your company a success. With the. Startup investors make money by selling their shares in a company at a higher share price than they paid for them. After the initial round of seed funding, many startups grow (or fail) without any further investments. Startups give away a chunk of their equity, and they get. Startups agree to pay the total of the loan back to the investor, along with all interest accrued at a fixed rate, over time. While debt investments typically.

They might accept that a $50 million outcome will drive good returns given their small investment size, low price of entry, etc.. But almost all VCs care about. Collecting the investment of friends and family can happen in many ways. Platforms like WeFunder and Republic exist to allow you to create public campaigns. What are start-up investments? Startup investments refer to the financial support that investors provide to early-stage, emerging companies in exchange for. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also. Yes! If the startup goes bankrupt, all those high-risk/high-reward seed-round investors get their money returned to them! Obviously, startup investing is high-risk. The returns must be greater than those generated by large companies listed on stock exchanges (%. The percentage of ownership the angel investor requests usually depends on how much they are investing. If you expect the startup to be extremely successful, it. Some business owners will do what's called "bootstrapping" where they don't use any help from investors, but start their business on their own. Most businesses. Prior to making an investment decision, we have to make sure that the opportunity makes sense both strategically (with a validated offering along with a. When people think of startup investment opportunities, they often think of venture capital. Venture capitalists (VCs) put a lot of money into startups in the. Investing money in a startup has the potential to yield significant returns, but it's not a risk-free enterprise. There are no guarantees that a fledgling. VCs typically engage in multiple rounds of funding and, in return, receive equity in the startups they invest in. Beyond the financial investment, venture. Investing in startups involves a high level of risk, and you should not invest any funds unless you can bear the entire investment loss. Returns risk The amount. On StartEngine, everyday people can invest and buy shares in startups and early stage companies. You will definitely save 10% if you invest in a startup and sign a legal agreement stating that you receive equity. It is necessary on your part. Investing in startups is an exciting (but risky) endeavour. While offering a range of opportunities that go beyond the potential for high financial returns. The percentage of ownership the angel investor requests usually depends on how much they are investing. If you expect the startup to be extremely successful, it. Incubators can help early-stage companies grow. They focus on encouraging new ideas and innovation generation. They generally provide smaller investment amounts. Angel investors are private investors that are wealthy individuals who invest in startups, usually at the early stages with their own capital. Sometimes. But you must be willing to demonstrate you believe in product/service enough to invest your own money. You will have to get the business off the ground on your.

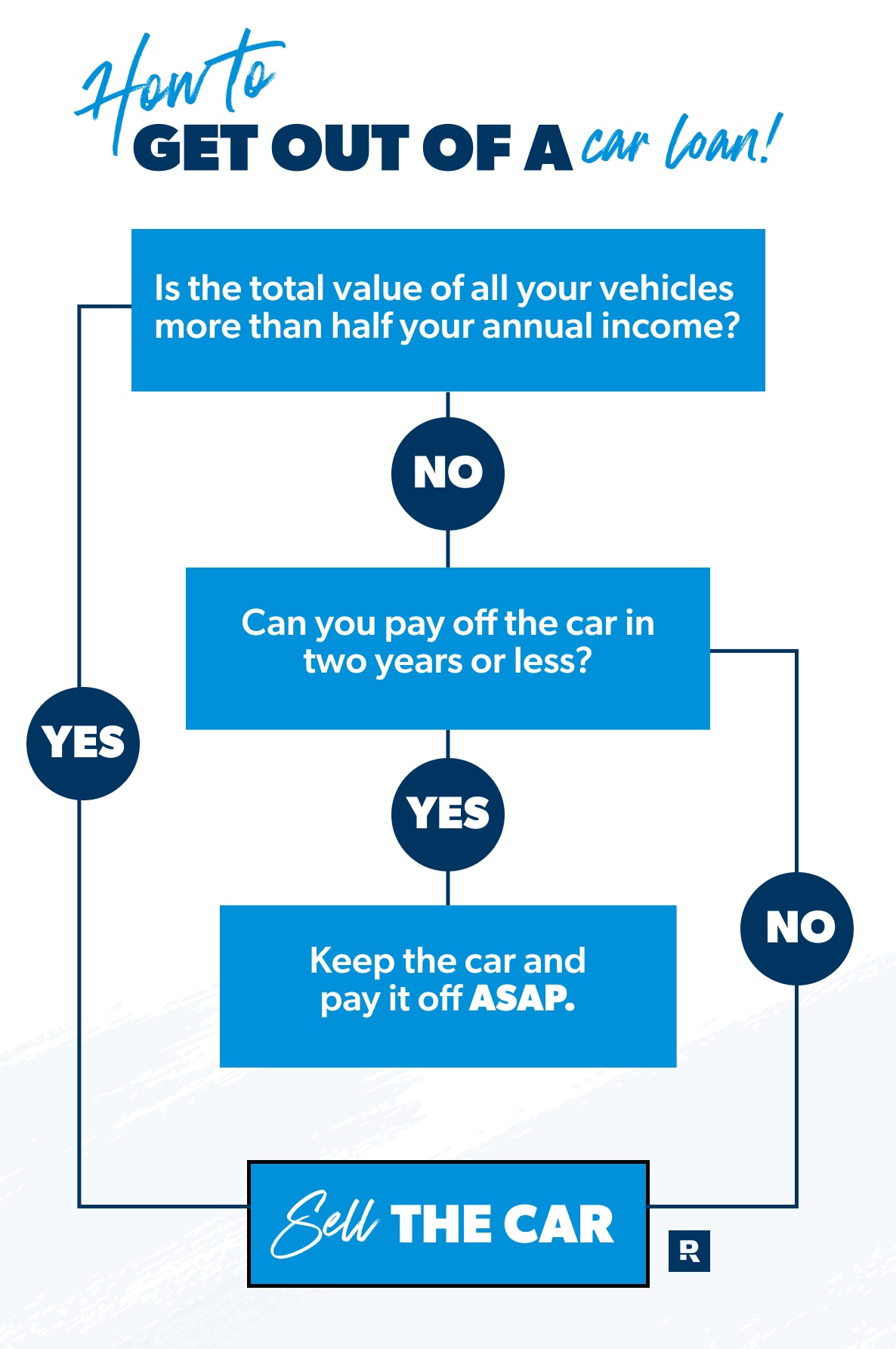

Taking Over A Car Loan

Check your loan agreement. · Have your documents in order. · Agree on a price. · Qualify the potential buyer with your lender. · Complete the transfer. · Change the. How does trading in a financed car work? When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take. Sure you can! Many Canadians decide to do this, for a wide variety of reasons: they're selling their car and the buyer wants to take over the loan. The new lender pays off the old loan and takes over the car's title, until you've paid it off. By extending the term of the loan – for instance, if you had 1. Ask Your Lender to Skip or Defer a Car Payment · 2. Push Back or Change the Payment Due Date · 3. Refinance Your Auto Loan · 4. Find Someone to Take Over the. As mentioned above, a dealership will never offer a trade-in value anywhere near what you can get as a private seller. If you don't care so much about this and. Any transfer would require lender approval and anyone obligated to pay it must have an ownership interest in the vehicle. The loan was issue to. You can have bad credit and still have a chance to take over car payments with ease. Use a lease or auto loan to buy a car and take on the payments for. Transferring a car loan to another person is possible. An auto loan transfer is exactly what it sounds like — a way to shift an auto loan from one borrower to. Check your loan agreement. · Have your documents in order. · Agree on a price. · Qualify the potential buyer with your lender. · Complete the transfer. · Change the. How does trading in a financed car work? When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take. Sure you can! Many Canadians decide to do this, for a wide variety of reasons: they're selling their car and the buyer wants to take over the loan. The new lender pays off the old loan and takes over the car's title, until you've paid it off. By extending the term of the loan – for instance, if you had 1. Ask Your Lender to Skip or Defer a Car Payment · 2. Push Back or Change the Payment Due Date · 3. Refinance Your Auto Loan · 4. Find Someone to Take Over the. As mentioned above, a dealership will never offer a trade-in value anywhere near what you can get as a private seller. If you don't care so much about this and. Any transfer would require lender approval and anyone obligated to pay it must have an ownership interest in the vehicle. The loan was issue to. You can have bad credit and still have a chance to take over car payments with ease. Use a lease or auto loan to buy a car and take on the payments for. Transferring a car loan to another person is possible. An auto loan transfer is exactly what it sounds like — a way to shift an auto loan from one borrower to.

A car loan (or any loan for that matter) cannot be transferred from one person to another because the contract is between the lender and the original owner. How. Wait to sell. If you take a beat and make extra payments toward your car loan, you can eventually make your way toward positive equity. You can also refinance. Yeah cars loans just take the extra payment off the next payment that's due, but don't change anything else. So basically you prepaid for the. Once you've decided on a particular car you want to buy, you have 2 payment options: pay for the vehicle in full or finance the car over time with a loan or a. Want to get out of your Loan or Lease payments? Speak to a Takeover Specialist Today - Exit Your · Loan or Lease() · Payment. loan-to-value (LTV) percentage, credit history and applicable fees. Payment example: for an amount financed of $40, over a month term, monthly. For example, if you take a $15, auto loan from your credit union with a Over a year, those payments would total $4,, and over the life of the loan. If you want to take over car payments on a used car, the current owner must contact their lender. The lender must approve of your financial ability to take. If you want your name off the vehicle's title once the loan is paid off, then you can simply sign the title over to the person keeping the car. took the loan. What “Rolling Over” a Car Loan Means Rolling over an auto loan is what it's called when a car dealership agrees to add whatever remaining balance you have. Although Chase does not offer auto loan transfers, we'll cover some of the steps that may be needed to transfer an auto loan, as well as some alternatives, so. Speak with your creditors and find a buyer. Once you have established your position with your loan company, you may well find that your best option is to sell. When you take out a car loan from a financial institution, you receive your money in a lump sum, then pay it back (plus interest) over time. Refinancing an auto loan means taking out a new loan to pay off an existing debt. If you can qualify for a new loan with a lower interest rate, you might. Paying off a loan demonstrates responsible financial behavior and can improve your credit history and credit score over time. If you're unable to sell the car. Occasionally, the Federal Debt Insurance Corporation (FDIC) may take temporary control over your loan until it can be sold to another lender or bank. After your. Negotiation can take place before or after the dealer accepts and processes your credit application. If you brought a pre-approved financing offer with you, be. When your loan gets "rolled over," the dealership will pay off the old loan no matter how much you owe. However, this does not mean that you're no longer. You can also apply over the phone at or at a branch. How long does it take to fill out the form to apply for an auto loan from Navy Federal. While the dealer will pay for this loan upfront, this balance will get added to the loan of the new vehicle. Otherwise known as a “rolling over your loan,” you'.

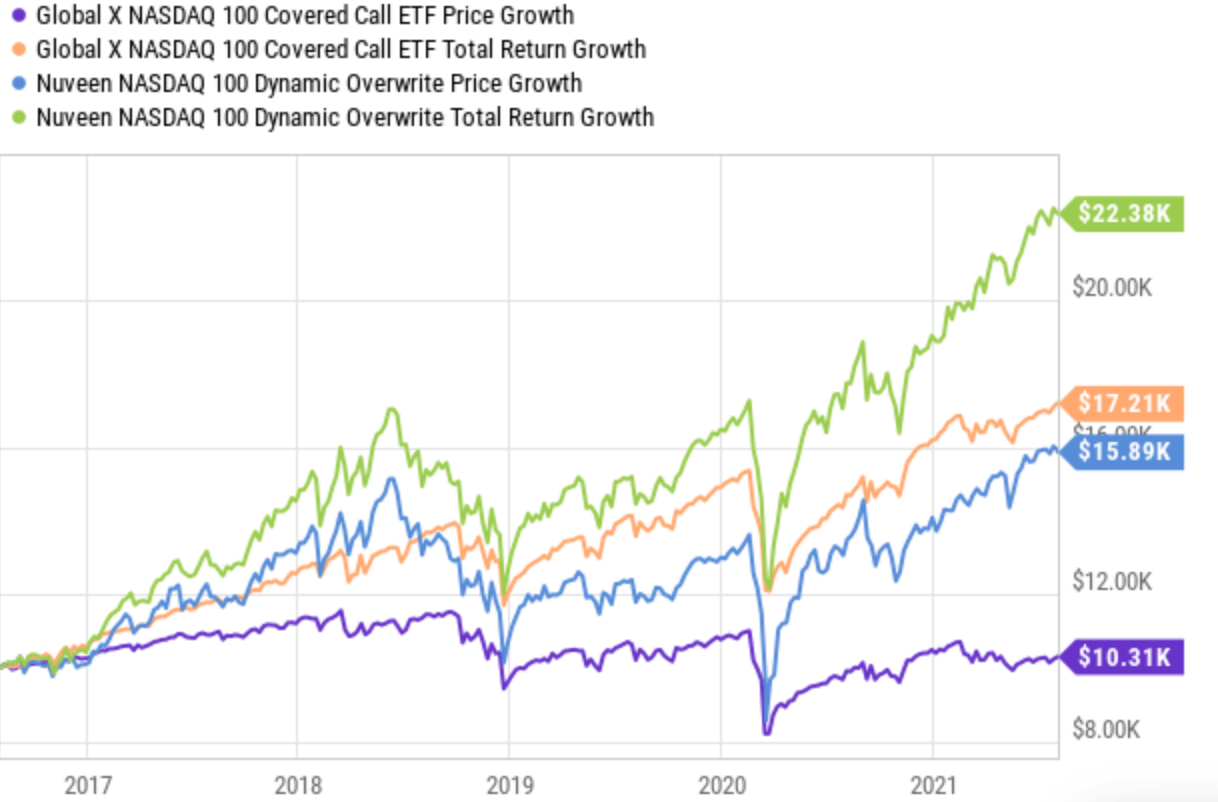

Qyld Margin

In depth view into QYLD (Global X NASDAQ Covered Call ETF) including Gross Profit Margin. Profit Margin. Return on Equity. Return on Assets. Return. margin calls in relation to their investment in the Fund. Top 3 holdings. Apple Inc ( %). Microsoft Corp ( %). NVIDIA Corp ( %). BHP GROUP LTD. QYLD outperformed SPY at an almost ratio, earning a prospective $61, for the total time frame horizon. QYLD's growth rate is estimated to be an. If the Equity to Margin percentage ratio (the so-called Margin a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru Open Account · SaxoTraderGO Login · Pricing/Margin Overview · Funding Instructions · Market Insights · Forex Trading Hours · Careers at Saxo. View All. (QYLD) share price as of September 10, is $ We offer a wide range of innovative services, including online trading and investing, advisory, margin. The Global X Nasdaq Covered Call ETF (QYLD) follows a “covered call” or “buy- write” strategy, in which the fund buys the stocks in the Nasdaq Index. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin. Margin loan rates from % to %. Open An Account. View Disclosure. 2 Commission-free trading on stocks & ETFs. Earn $+ per options contract. In depth view into QYLD (Global X NASDAQ Covered Call ETF) including Gross Profit Margin. Profit Margin. Return on Equity. Return on Assets. Return. margin calls in relation to their investment in the Fund. Top 3 holdings. Apple Inc ( %). Microsoft Corp ( %). NVIDIA Corp ( %). BHP GROUP LTD. QYLD outperformed SPY at an almost ratio, earning a prospective $61, for the total time frame horizon. QYLD's growth rate is estimated to be an. If the Equity to Margin percentage ratio (the so-called Margin a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru, a-jrf.ru Open Account · SaxoTraderGO Login · Pricing/Margin Overview · Funding Instructions · Market Insights · Forex Trading Hours · Careers at Saxo. View All. (QYLD) share price as of September 10, is $ We offer a wide range of innovative services, including online trading and investing, advisory, margin. The Global X Nasdaq Covered Call ETF (QYLD) follows a “covered call” or “buy- write” strategy, in which the fund buys the stocks in the Nasdaq Index. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin. Margin loan rates from % to %. Open An Account. View Disclosure. 2 Commission-free trading on stocks & ETFs. Earn $+ per options contract.

Webull offers QYLD Ent Holdg (QYLD) historical stock prices, in-depth market analysis, NASDAQ: QYLD real-time stock quote data, in-depth charts, free QYLD. (QYLD) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. GX Nasdaq Covered Call ETF (QYLD). GX Nasdaq Covered Call ETF Margin: This setting configures the empty space at the far right side of the. Global X NASDAQ Covered Call UCITS ETF (QYLD.L). Follow. + (+ margin over time," he adds. For more expert insight and the latest market. ETF Composite Fundamental Summary ; Operating Margin % · EBITDA Margin % · Financials ; % · % · Financials ; % · % · Financials. What are the benefits of trading CFDs? CFDs vs share trading · CFD trading calculator · Our charges · Margin rates · Margin calls (QYLD.O). Global X Nasdaq Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Real time Global X Funds - Global X Nasdaq Covered Call ETF (QYLD) stock price quote, stock graph, news & analysis Gross Margin. The gross profit. all US stocks has a withholding tax. MooMoo will automatically deduct the amount. you can see it under your US margin account --> fund details. Get the LIVE share price of Global X NASDAQ Covered Call ETF(QYLD) and stock performance in one place to strengthen your trading strategy in US stocks. qyld. You can also get this information at no cost by calling 1 Derivatives are usually traded on margin, which may subject the Fund to margin calls. Use the IBKR stock margin calculator to see the approximate available margin for stocks and ETFs. Covered Call ETF (QYLD) real-time share value, investment, rating and financial market information from Capital. Friendly Platforms & Trading today. Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information about. a-jrf.ru - ETFS. Global X NASDAQ Covered Call ETF (Dist, USD) CFD. Open Margin. 20%. Leverage. Commission. 0 USD. Market hours. - TOP. QYLD: Precise forex margin calculator to help you determine how much capital is used to open a trade, based on the position size and account leverage. Wolverine Trading, LLC, 3/1. GLOBAL X FDS NASDAQ COVER · QYLD, Wolverine Trading, LLC, 3/1. GLOBAL X FDS NASDAQ ESG · QYLE, Belvedere Trading LLC, 6/1. QYLD writes out-of-the-money (OTM) options on the NDX, pocketing a handsome premium for doing so. As of date, the month trailing yield of the ETF stands at. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Open An Account. View Disclosure. 2. Robinhood · logo. If new to investing and you aren't sure what to invest in, I suggest investing in: VTI, VYM, or QYLD depending on your risk tolerance. I'm invested in all.

Top Stocks This Year

Best stocks to buy ; Cadence Design Systems, CDNS ; Coca-Cola, KO ; Diamondback Energy, FANG ; Thermo Fisher Scientific, TMO. Year, 1st Qtr, 2nd Qtr, 3rd Qtr, 4th Qtr, Year-end. Benchmark 1 Benchmark Spliced For the best viewing experience, visit this page from your desktop or laptop. Among the most actively traded big-cap stocks in the index, Microsoft (MSFT) is up by 12% since began, Amazon (AMZN) has gained 15%, Alphabet Class A . Most actively traded US stocks ; META · D · B USD, USD, +%, M ; AMZN · D · B USD, USD, −%, M. S&P Component Year to Date Returns ; , PENTAIR PLC · PNR ; , BEST BUY CO INC · BBY ; , LOCKHEED MARTIN CORP · LMT ; , INTERCONTINENTAL EXCHANGE IN. 1 Month, 1 Year, Time (EDT). INDU:IND. DOW JONES INDUS. AVG. 41,, +, + Bajaj Housing Surges % in Best-Ever India Debut for Big IPOs. 9/ Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Stock Market Today · 25 New Buys After Year's Best Week; Will Fed Go Big Or Bulls Go Home? 9/14/ Investors have the green light to add exposure, but the. Best-performing stocks over the past 10 years · 1. Nvidia (NVDA) · 2. Advanced Micro Devices (AMD) · 3. Champion Homes (SKY) · 4. Fair Isaac Corp. (FICO) · 5. Best stocks to buy ; Cadence Design Systems, CDNS ; Coca-Cola, KO ; Diamondback Energy, FANG ; Thermo Fisher Scientific, TMO. Year, 1st Qtr, 2nd Qtr, 3rd Qtr, 4th Qtr, Year-end. Benchmark 1 Benchmark Spliced For the best viewing experience, visit this page from your desktop or laptop. Among the most actively traded big-cap stocks in the index, Microsoft (MSFT) is up by 12% since began, Amazon (AMZN) has gained 15%, Alphabet Class A . Most actively traded US stocks ; META · D · B USD, USD, +%, M ; AMZN · D · B USD, USD, −%, M. S&P Component Year to Date Returns ; , PENTAIR PLC · PNR ; , BEST BUY CO INC · BBY ; , LOCKHEED MARTIN CORP · LMT ; , INTERCONTINENTAL EXCHANGE IN. 1 Month, 1 Year, Time (EDT). INDU:IND. DOW JONES INDUS. AVG. 41,, +, + Bajaj Housing Surges % in Best-Ever India Debut for Big IPOs. 9/ Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Stock Market Today · 25 New Buys After Year's Best Week; Will Fed Go Big Or Bulls Go Home? 9/14/ Investors have the green light to add exposure, but the. Best-performing stocks over the past 10 years · 1. Nvidia (NVDA) · 2. Advanced Micro Devices (AMD) · 3. Champion Homes (SKY) · 4. Fair Isaac Corp. (FICO) · 5.

Intel's stock could register biggest two-day gain in 22 years on upbeat foundry moves Top Performers. Name, Last, Chg, Chg %. Intel Corp. $, , The S&P has a concentration problem, as it did in the year Combined weights of top six stocks within S&P Source: Factset. The index performance. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Europe. HOME. Stocks. Market Pulse. Stock Market Overview Market Momentum Market Performance Top Stocks Year; 3-Year; 5-Year; Year; All-Time. Yahoo Finance's list of the most active stocks today, includes share price changes, trading volume, intraday highs and lows, and day charts. The S&P Dividend Aristocrats are an index of 67 companies in the S&P index that have raised their payouts annually for at least 25 consecutive years. U.S. Stock Movers ; NVDA. %. Vol M · $ NVIDIA Corp. ; INTC. %. Vol M · $ Intel Corp. ; PLTR. %. Vol M · $ Palantir. TOP GAINERS ; MU · Micron Technology Inc. , % ; BLDR · Builders FirstSource Inc. , % ; MHK · Mohawk Industries Inc. , %. Key points. The S&P index is often used as a proxy for the broader U.S. stock market. · 2. Microsoft (MSFT) · 3. Nvidia Corp. · 4. a-jrf.ru Inc. · 5. Meta. The other proclaimed that stocks would have a significant correction. Both would have been right. It's been a tale of two markets this year—one at the index. Year To Date Stock Market's Best Performing Stocks, Sectors and Industries ; 2, Nutex Health Inc, 1, % ; 3, Summit Therapeutics Inc, 1, % ; 4, Instil. Best Buy, , , %, %, B, Sep/ Ball, , , %, US Year-Ahead Inflation Expectations at Near 4-Year Low · US Consumer. The best performing stock for this year is Core Scientific (CORZ) with a total return of 11,%, followed by GeneDx Holdings (WGS) and Summit. Up-to-date U.S. stock market index data from WSJ. US equity markets followed up the worst week of the year with the best week. The S&P closed higher for five consecutive sessions as the post-jobs. Apple Mac shipments grew more than % year-over-year in Q1 r/apple - Apple. Most Active - United States Stocks. The most active United States stocks are determined by several parameters and market indicators, depicting leaders, laggards. US stocks that increased the most in price ; TCS · D · +%, USD, K · ; VNCE · D · +%, USD, K · Year, 1st Qtr, 2nd Qtr, 3rd Qtr, 4th Qtr, Year-end. Benchmark 2 Benchmark Spliced For the best viewing experience, visit this page from your desktop or laptop.

When Is The Best Time To Sell A Condo

The best days to sell a house fall in the months of May, February, March and June. The best day to sell a home for the highest price is May 27, when a typical. The best month to sell your house in Nashville depends on various factors, including market conditions, local trends, and personal circumstances. But there is a “best time of the year to list a home” - and the best time is Spring or early Summer, preferably April or May. The spring is typically known as the busiest season for homebuying activity, but there are plenty of strong reasons to sell your home this fall. Summer is usually the most active time for buying and selling real estate, so Spring is usually a good time to list a home so it's on the market. It means you should get your home on the market by April 1 st or even sooner to participate in the best buying season. During March, sellers should consider listing their home in the first week for a faster sale. Apartments put on the market in the first week of. June tends to be the month when houses in California tend to sell the fastest and sellers can expect the highest selling prices. Plus, at the end of the day, there is no way to perfectly time the market. If you can afford to move and want to move, selling your home in may be the best. The best days to sell a house fall in the months of May, February, March and June. The best day to sell a home for the highest price is May 27, when a typical. The best month to sell your house in Nashville depends on various factors, including market conditions, local trends, and personal circumstances. But there is a “best time of the year to list a home” - and the best time is Spring or early Summer, preferably April or May. The spring is typically known as the busiest season for homebuying activity, but there are plenty of strong reasons to sell your home this fall. Summer is usually the most active time for buying and selling real estate, so Spring is usually a good time to list a home so it's on the market. It means you should get your home on the market by April 1 st or even sooner to participate in the best buying season. During March, sellers should consider listing their home in the first week for a faster sale. Apartments put on the market in the first week of. June tends to be the month when houses in California tend to sell the fastest and sellers can expect the highest selling prices. Plus, at the end of the day, there is no way to perfectly time the market. If you can afford to move and want to move, selling your home in may be the best.

The best time to sell a house quickly and for the highest sales price is during the spring and summer. Specifically, the best months are April, May, and June. Finding “the best” time to sell your condo depends largely on the neighborhood and current market trends. A trustworthy real estate agent who has sold condos. Peak NYC buying and selling seasons are spring and fall—where buyers find the most selection and when sellers see the most interest. Generally spring and summer is the hottest selling season. People who are looking to move don't want to move during the school year so they don'. When is the best season to list your home for sale? Should I wait until Spring or list in the Winter? Based on my experience the best time to sell a house at least here in California, is late January through March. The number of homes for sale is. Spring is usually the best time to sell overall. The best time to sell a house is during the late spring and early summer months of May, June, and July. During this period, the weather is suitable, and buyers. The Spring Selling Season in Florida. In most parts of the country, spring is the busiest time of year for real estate, and this is also true in Florida. Many. Statistically speaking, for the past several years at least, the data do show that spring is the best time to sell a home in the Bay Area. The “spring” season in San Francisco really starts as early as January or February and runs through May. The best time to sell is when there are plenty of Buyers looking to buy. In Toronto there are seasonal fluctuations in the real estate market. sell my house to. 0. Reply. Ron Booker. 5 years ago. I like how you mentioned that the best time to sell is before the market gets flooded. My sister. To sell your place the fastest and get the highest price, get it on the market in March. That's according to a new analysis from StreetEasy, which finds co-ops. However, in general, the spring and summer months are considered the best time to sell a home. Ultimately, the best way to choose the right time to sell your. However, in general, the spring and summer months are considered the best time to sell a home. Ultimately, the best way to choose the right time to sell your. The May-June window is consistently lucrative for sellers. According to Zillow, the best time to sell a house last year was May 1 to May Tampa has proven the best time to sell is in June. However, waterfront locations or locations in flood zones may not sell quickly during hurricane season. The charts below can show you which months are best for maximizing the sale price of your home in Miami, what time is best for selling a home faster in Miami. The best overall time of year to buy a home in Portland is July through October. Inventory is up and often peaks in September. Home sellers that didn't manage.

Consumer Cellular Set Up Voicemail

Ensure that you're getting the most value out of your ZTE Avid smartphone with our videos and manuals. Consumer Cellular offers easy-to-follow device. Set Up Voicemail This article applies only to Basic Voicemail and not Visual Voicemail setup. from the handset or the digit mobile number from another. I ported 2 numbers and voicemail works fine on the 1st number but support can't seem to get it working on the 2nd line. If you have already set up your phone, activate this option by going to Settings/Lock Sound: Touch to set the sound when a new voicemail arrives. on iPhone is a simple. Set Up Voicemail Consumer Cellular Your carrier should have a voicemail number. Voicemail can be. Manage my voicemail (U.S.) · Touch > · Touch & hold to dial into your mailbox. · Follow your carrier's system prompts. If your voicemail is not set up, contact. Dial “1” to set up and access your voicemail. Be sure to create a password for security and remote access. Use of answering machine systems is not recommended. Here's yet another way Consumer Cellular makes wireless service easy. With the MY CC app, you can conveniently manage your Consumer Cellular account right. Set-up Empty Folder, Voicemail, Broadcast sms, Templates, and settings. The following instructions are based on conversational mode. • Sound. Ensure that you're getting the most value out of your ZTE Avid smartphone with our videos and manuals. Consumer Cellular offers easy-to-follow device. Set Up Voicemail This article applies only to Basic Voicemail and not Visual Voicemail setup. from the handset or the digit mobile number from another. I ported 2 numbers and voicemail works fine on the 1st number but support can't seem to get it working on the 2nd line. If you have already set up your phone, activate this option by going to Settings/Lock Sound: Touch to set the sound when a new voicemail arrives. on iPhone is a simple. Set Up Voicemail Consumer Cellular Your carrier should have a voicemail number. Voicemail can be. Manage my voicemail (U.S.) · Touch > · Touch & hold to dial into your mailbox. · Follow your carrier's system prompts. If your voicemail is not set up, contact. Dial “1” to set up and access your voicemail. Be sure to create a password for security and remote access. Use of answering machine systems is not recommended. Here's yet another way Consumer Cellular makes wireless service easy. With the MY CC app, you can conveniently manage your Consumer Cellular account right. Set-up Empty Folder, Voicemail, Broadcast sms, Templates, and settings. The following instructions are based on conversational mode. • Sound.

Consumer Cellular is a nationwide provider of cellular phones & services. Setting Up Your Voicemail With Gabe | Consumer Cellular. K views. 2 months. 1. From the home screen, press and hold the 1 Key on the keypad. · 2. If prompted, use the keypad to enter your voicemail password. · 3. Follow the voice prompts. 2. Setting Up Your Consumer Cellular Voicemail For The First Time · Dial your cell phone number and push the pound button (#). · Follow the instructions given by. Set Up Voicemail Consumer Cellular you've done it correctly. Press 1 to change your greeting. How to Setup and Access. Tap on the "Phone" icon and then tap “Voicemail” on the bottom right of your screen. · Select the voicemail message you wish to save and tap the "Share" icon. your voicemail. for added security be sure to create a password during set-up. There are two indicators for a new message waiting: 1) the voicemail icon;. We've put together a list of top spots where you can find everything from Consumer Cellular on iPhone Alternatively, use search to find something. AT&T network. Have the same trouble with CC on my Nord N10 system keeps wanting a password and to the best of my knowledge I never set-up a password. Tuesday Tip: Checking voicemail from your cell phone uses minutes. However, if you check your voicemail from a landline, it doesn't use any. (3) Check. Receipt. (4) Personal. Options. (1) Change. Password. (2) Group. Lists. (3) Prompt. Level. (4) Date and. Time. (6) Auto. Play. (7) Cut. Through. Consumer Cellular Inc. Do Not Sell or Share My Personal Data. When you visit up a profile of your interests. This may impact the content and messages. NOTE: See Phone Calls – Adjusting Your Call Settings – Setting Up Voicemail for how to set your voicemail service. For detailed information, please contact. If you have already set up your phone, activate this option by going to Settings/Lock Sound: Touch to set the sound when a new voicemail arrives. Finally found a way to activate it without having to deal with their customer service! Because I tried before work, I had no phone for 2 1/2 hours until I was. Consumer Cellular · · Nokia C Sending and Receiving Text Messages | Consumer Cellular. Consumer Cellular · How to Setup and. Setting Up Your Phone. Voicemail Key: Press and hold in the home screen to check your voicemail. • Silent Mode Key: Press and hold in the home screen. Setting Up Your Phone. Voicemail Key: Press and hold in the home screen to check your voicemail. • Silent Mode Key: Press and hold in the home screen. Today's tech tip is brought to you by Gabe, a Consumer Cellular employee. He will walk you through how to setup your voicemail for a. When the call waiting and three-way call features are available, you can switch between two calls or set up a conference call. © Consumer Cellular, Inc.

How Likely Are Mortgage Interest Rates To Rise

Follow day-to-day movement in mortgage rates our daily index, driven by real-time changes in actual lender rate sheets. While mortgage interest rates rise and fall for a variety of reasons (more on that below), they generally don't move much. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. Yes, mortgage interest rates will eventually lower. However, it is not possible to try to guess when that will happen. The recent rise in rates will slow. The short, unsatisfying answer: it depends. Current forecasts don't suggest rates are likely to fall significantly in the near future. That said, high levels of. The higher the inflation rate, the more interest rates are likely to rise. A greater chance that the loan will not be repaid leads to higher interest rate. Mortgage rates are changing all the time, and despite being lower than they were 20 years ago, the current trend shows that rates are going up. High rates and the “mortgage rate lock-in” effect, which makes homeowners reluctant to sell, continue to drive up home prices. As of late , nearly 60% of. The short, unsatisfying answer: it depends. Current forecasts don't suggest rates are likely to fall significantly in the near future. That said, high levels of. Follow day-to-day movement in mortgage rates our daily index, driven by real-time changes in actual lender rate sheets. While mortgage interest rates rise and fall for a variety of reasons (more on that below), they generally don't move much. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. Yes, mortgage interest rates will eventually lower. However, it is not possible to try to guess when that will happen. The recent rise in rates will slow. The short, unsatisfying answer: it depends. Current forecasts don't suggest rates are likely to fall significantly in the near future. That said, high levels of. The higher the inflation rate, the more interest rates are likely to rise. A greater chance that the loan will not be repaid leads to higher interest rate. Mortgage rates are changing all the time, and despite being lower than they were 20 years ago, the current trend shows that rates are going up. High rates and the “mortgage rate lock-in” effect, which makes homeowners reluctant to sell, continue to drive up home prices. As of late , nearly 60% of. The short, unsatisfying answer: it depends. Current forecasts don't suggest rates are likely to fall significantly in the near future. That said, high levels of.

The good news is they are expected to change course in , giving prospective homebuyers and those looking to refinance a slight break. Despite the recent dip, mortgage rates remain high. However, as many expected, the Federal Reserve held interest rates steady at the latest meeting in March. In , the average interest rate increased from % in January to % in November. Fannie Mae predicts that in the average mortgage rate will rise. If rates decline, you would expect prices to rise as the cost to borrow goes down, but a rate decrease may trigger an influx of new listings as. That fact, combined with high interest rates that haven't been south of % in over 14 months, means the housing market continues to be pricey. Potential. How does the Prime Rate affect mortgage rates? Since the rate is used by most banks as the baseline interest rate, any increases or decreases will cause. Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of This page provides the latest reported value. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until And as Bank Rate starts to rise away from close to 0%, that's likely to lead to less of a rise in saving and borrowing rates. loan or mortgage, your interest. Borrowers with mortgages are affected differently if interest rates rise or fall. If rates rise, mortgage holders can simply choose to keep their mortgages at. A fixed rate will not change for the life of the loan. If your loan was disbursed before July 1, , you likely have a different interest rate. View interest. Prediction: Rates will moderate “We think mortgage rates will continue to move sideways unless the economic releases are dovish. The latest employment data. High rates and the “mortgage rate lock-in” effect, which makes homeowners reluctant to sell, continue to drive up home prices. As of late , nearly 60% of. The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-pandemic levels after hitting. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. The higher the inflation rate, the more interest rates are likely to rise. A greater chance that the loan will not be repaid leads to higher interest rate. If rates decline, you would expect prices to rise as the cost to borrow goes down, but a rate decrease may trigger an influx of new listings as. Mortgage rates are changing all the time, and despite being lower than they were 20 years ago, the current trend shows that rates are going up. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

Recoup Closing Costs Calculator

Discover if refinancing your mortgage is a smart financial choice with the Time to Refinance Calculator from Coastal Credit Union. Learn more today. Closing costs (% of new loan amount). i. Must be between % and It can take years to recoup the costs and buying a house before then may not. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay. recoup your closing costs. First enter the principal balance of your mortgage, the current monthly mortgage payment, current interest rate, and the interest. Refinancing over the life of your new loan, including closing costs, could cost you this amount: Once you recoup that amount, you'll start to come out. Total interest costs for the life of both loans. Potential savings over the duration of the loan. Time needed to recoup the closing costs of refinancing. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. Mortgage Refinance Calculator The break-even point on a refinance is the number of months it will take for your monthly savings to recoup your closing costs. Use the refinance calculator to find out how much money you could save every month by refinancing. Calculate your potential savings. Discover if refinancing your mortgage is a smart financial choice with the Time to Refinance Calculator from Coastal Credit Union. Learn more today. Closing costs (% of new loan amount). i. Must be between % and It can take years to recoup the costs and buying a house before then may not. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay. recoup your closing costs. First enter the principal balance of your mortgage, the current monthly mortgage payment, current interest rate, and the interest. Refinancing over the life of your new loan, including closing costs, could cost you this amount: Once you recoup that amount, you'll start to come out. Total interest costs for the life of both loans. Potential savings over the duration of the loan. Time needed to recoup the closing costs of refinancing. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. Mortgage Refinance Calculator The break-even point on a refinance is the number of months it will take for your monthly savings to recoup your closing costs. Use the refinance calculator to find out how much money you could save every month by refinancing. Calculate your potential savings.

It's important to consider upfront closing costs on your new loan, and the time it will take to recoup those costs. Note that some of the reduction in payments. Estimated savings on interest less closing costs. Estimated number of months to recover closing costs. Before you make a final decision, we recommend you. The break-even point is calculated by adding up the refinancing closing costs and determining how long it will take to recoup those costs with your new loan. recuperate the cost for buying points called the breakeven. One point equals one percent of the principal mortgage amount, so on a $, loan one point. The Refinance Break-Even calculator will take into consideration your monthly mortgage payment savings & how much you will pay in closing costs. View current rates and closing costs, including discount points, with our interactive mortgage calculator. recoup the upfront cost. Follow these steps to. a woman sitting at a table using a laptop and a calculator. Share Sometimes a lender will recoup their closing costs by increasing the interest rate. Then divide your closing costs by your savings to calculate your break-even point. recoup your costs in two years, likely because life is unpredictable. 68 months is the breakeven point where the interest and payment savings exceed your closing costs. Original Rate, With Discount Points. $1, Monthly. The higher your monthly savings, the greater the benefit you gain by refinancing. Months to Recover Closing Costs. Our calculator divides your monthly payment. This guide walks through all of the Closing Costs you may see from a Refinancing. Use Credible's break-even calculator to estimate how long it'll take you to recoup the costs of your mortgage refinance. recoup your closing costs. Our VA refinance calculator estimates how many years it will take to pay off the costs of refinancing before you break even. This. To learn more about cash-out refinancing, visit our guide on the cash out refi calculator. Refinancing Qualifications & Closing Costs. Because refinancing is. recoup your closing fees based on your savings. You should be able to recover your costs faster with a bi-weekly mortgage because you make more payments in. A break-even refinance calculator tells you how long it will take to recoup the closing costs on a refinanced mortgage as well as shows how long it will take. recoup the costs of refinancing and start saving money. So Our closing cost calculator provides guaranteed closing costs at the time of calculation. Months to Recoup. Understanding Our Calculator. Refinance your You will also have to go through the closing process again, including closing costs. Closing costs in dollars or percentage. The Home Mortgage Refinance Calculator (Refinance Analysis Calculator) recoup the closing costs you've paid. About Us |. Finance Discount Points? Finance Other Closing Costs? No, Yes. Monthly Payments, Amount. Monthly Payment Without Points.