a-jrf.ru

Community

Appl Stock Chart

In depth view into Apple Price including historical data from , charts and stats. AAPL - Apple Inc - Stock screener for investors and traders, financial visualizations AAPL - Stock Price Chart. Held by: VTI VOO SPY IVV VUG QQQ VGT IWF IVW. The current price of AAPL is USD — it has decreased by −% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. Apple Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time AAPL stock price. Historical daily share price chart and data for Apple since adjusted for splits and dividends. The latest closing stock price for Apple as of August Apple Share Price Live Today:Get the Live stock price of AAPL Inc., and quote, performance, latest news to help you with stock trading and investing. Discover historical prices for AAPL stock on Yahoo Finance. View daily, weekly or monthly format back to when Apple Inc. stock was issued. Invest in stocks! In our "Charts" section you can find AAPL live quotes for the CFD on Stock. In front of you - a live chart for Apple Inc. (AAPL). Apple Inc. Common Stock (AAPL) interactive stock charts, quotes, and comparrisons for US and global markets. No one knows the market like Nasdaq. In depth view into Apple Price including historical data from , charts and stats. AAPL - Apple Inc - Stock screener for investors and traders, financial visualizations AAPL - Stock Price Chart. Held by: VTI VOO SPY IVV VUG QQQ VGT IWF IVW. The current price of AAPL is USD — it has decreased by −% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. Apple Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time AAPL stock price. Historical daily share price chart and data for Apple since adjusted for splits and dividends. The latest closing stock price for Apple as of August Apple Share Price Live Today:Get the Live stock price of AAPL Inc., and quote, performance, latest news to help you with stock trading and investing. Discover historical prices for AAPL stock on Yahoo Finance. View daily, weekly or monthly format back to when Apple Inc. stock was issued. Invest in stocks! In our "Charts" section you can find AAPL live quotes for the CFD on Stock. In front of you - a live chart for Apple Inc. (AAPL). Apple Inc. Common Stock (AAPL) interactive stock charts, quotes, and comparrisons for US and global markets. No one knows the market like Nasdaq.

Apple stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. Live Apple Inc chart, AAPL stock price in real-time and AAPL historical prices. View live Apple Inc chart to track its stock's price action. Find market predictions, AAPL financials and market news. View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low View today's Apple Inc stock price and latest AAPL news and analysis. Create real-time notifications to follow any changes in the live stock price. Apple live price charts and stock performance over time. Use technical analysis tools such as candles & Fibonacci to generate different instrument. Apple Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. AAPL, $AAPL, Apple Inc stock technical analysis with charts, breakout and price targets, support and resistance levels, and more trend analysis indicators. Stock analysis for Apple Inc (AAPL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The Apple Inc stock price today is How can the stock chart for Apple Inc be customized? Users can customize the stock graph by selecting different time. Charts · Financials · Historical Quotes · Analyst Estimates · Options · Premium Tools. AAPL Overview. Key Data. Open $; Day Range - ; 52 Week. Apple Inc. advanced stock charts by Barron's. View AAPL historical stock data and compare to other stocks, and exchanges. Get the current share price of Apple (AAPL) stock. Current & historical charts, research AAPL's performance, total return and many other metrics free. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. In depth view into AAPL (Apple) stock including the latest price, news, dividend history, earnings information and financials. Apple Inc. share price in real-time ( / US), charts and analyses, news, key data, turnovers, company data. Track Apple Inc (AAPL) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Apple (AAPL) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD. View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN.

Soyb Stock Price

What Is the SOYB Stock Price Today? The SOYB stock price today is What Stock Exchange Is SOYB Traded On? SOYB is listed and trades on the NYSE stock. U.S. · NYSE Arca ; SOYB. % ; Price at close. $ % ; Key Fund Data. Net Assets. $M · 52 Wk Range. - Yield. N/A. Net. Teucrium Soybean SOYB:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/30/23 · 52 Week Low View Teucrium Soybean Fund Etv (SOYB) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Teucrim Soybean (SOYB) · About Teucrim Soybean (SOYB) · Stock News. SOYB ETF Stock Price History ; Highest: ; Change %: ; Average: ; Difference: ; Lowest: View the real-time SOYB price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Track Teucrium Trading, LLC - Teucrium Soybean Fund (SOYB) Stock Price, Quote, latest community messages, chart, news and other stock related information. The Teucrium Soybean Fund (SOYB) provides investors an easy way to gain exposure to the price of soybeans futures in a brokerage account. What Is the SOYB Stock Price Today? The SOYB stock price today is What Stock Exchange Is SOYB Traded On? SOYB is listed and trades on the NYSE stock. U.S. · NYSE Arca ; SOYB. % ; Price at close. $ % ; Key Fund Data. Net Assets. $M · 52 Wk Range. - Yield. N/A. Net. Teucrium Soybean SOYB:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/30/23 · 52 Week Low View Teucrium Soybean Fund Etv (SOYB) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Teucrim Soybean (SOYB) · About Teucrim Soybean (SOYB) · Stock News. SOYB ETF Stock Price History ; Highest: ; Change %: ; Average: ; Difference: ; Lowest: View the real-time SOYB price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Track Teucrium Trading, LLC - Teucrium Soybean Fund (SOYB) Stock Price, Quote, latest community messages, chart, news and other stock related information. The Teucrium Soybean Fund (SOYB) provides investors an easy way to gain exposure to the price of soybeans futures in a brokerage account.

; Volume: K · 65 Day Avg: K ; Day Range ; 52 Week Range

View the latest Teucrium Soybean Fund (SOYB) stock price and news, and other vital information for better exchange traded fund investing. SOYB - Teucrium Commodity Trust - Teucrium Soybean Fund Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (ARCA) ; Owners. Institutional Owners. Teucrium Soybean Fund ETV (SOYB): Price and Financial Metrics ETF · Teucrium Soybean Fund ETV (SOYB): $ · Get Rating · Component Grades. Get WisdomTree Soybeans (SOYB^-IT:Milan Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Teucrium Soybean stocks price quote with latest real-time prices, charts Teucrium Soybean (SOYB). Teucrium Soybean (SOYB). + (+%) 08/ View Teucrium Soybean Etv (SOYB) stock price and volume charts for most recent trading day, 5-day, 1-month and longer monthly and yearly timeframes. Price: $ ; Change: $ (%) ; Category: Agricultural Commodities. Teucrium SOYB ETF (Teucrium Soybean ETF): stock price, performance, provider, sustainability, sectors, trading info. When the traded price is any other currency then the Trade Value is displayed in that currency. Some trades qualify for deferred publication due to the type or. Discover historical prices for SOYB stock on Yahoo Finance. View daily, weekly or monthly format back to when Teucrium Soybean stock was issued. What was SOYB's price range in the past 12 months? SOYB lowest ETF price was $ and its highest was $ in the past 12 months. ; What is the AUM of SOYB? An easy way to get Teucrium Soybean Fund ETV real-time prices. View live SOYB stock fund chart, financials, and market news. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. Get a real-time stock price quote for SOYB (Teucrium Soybean Fund). Also includes news, ETF details and other investing information. Teucrium Soybean ETF SOYB. Morningstar Rating. Performance; Quote; Analysis price; a 1-star stock isn't. If our base-case assumptions are true the. Get Teucrium Soybean (SOYB.K) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Real time Teucrium Commodity Trust - Teucrium Soybean Fund (SOYB) stock price quote, stock graph, news & analysis. WisdomTree Soybeans (SOYB) ; Trade low · $ ; Year low · $ ; Volume · 8, ; Dividend yield · n/a ; Currency · USD.

Hedge Fund Short Selling

Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Naked short selling is the shorting of stocks that you do not own. The That person could hedge the long position by shorting XYZ Company while it. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. In A.W. Jones established in the United States what is regarded as the first hedge fund. Jones combined two investment tools--short selling and leverage. The basis for the article is the Eurekahedge AI Hedge Fund Index In short: it's not AI or LLMs that are valuable in isolation. An investor that sells an asset short is, as to that asset, a short seller. Schematic representation of physical short selling in two steps. The short seller. If unrestricted, say ISLA, short selling can transfer information from informed investors to the less informed, allowing market prices to reflect a fairer value. 5 At the fund- quarter level, the likelihood of engaging in active short selling is % for activist hedge funds, relative to the unconditional likelihood of. Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period. Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Naked short selling is the shorting of stocks that you do not own. The That person could hedge the long position by shorting XYZ Company while it. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. In A.W. Jones established in the United States what is regarded as the first hedge fund. Jones combined two investment tools--short selling and leverage. The basis for the article is the Eurekahedge AI Hedge Fund Index In short: it's not AI or LLMs that are valuable in isolation. An investor that sells an asset short is, as to that asset, a short seller. Schematic representation of physical short selling in two steps. The short seller. If unrestricted, say ISLA, short selling can transfer information from informed investors to the less informed, allowing market prices to reflect a fairer value. 5 At the fund- quarter level, the likelihood of engaging in active short selling is % for activist hedge funds, relative to the unconditional likelihood of. Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period.

Short selling that helps companies raise capital is “good.” If companies can issue debt in the form of convertible, corporate, preferred stock, or distressed. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. A hedge fund may also invest in derivatives (such as options and futures) and use short-selling (selling a security it does not own) to increase its. In this example, short selling plays a cardinal role in protecting the value of the fund. Taking a macro view of global events, such as higher inflation. Hedge funds use short selling to deliver returns and shield their investors — including pensions, foundations, and endowments — from market volatility and asset. We manage quantitative, systematic and fundamental strategies, specialising predominantly in long/short equity. sell any security. Opinions expressed. The conventional long/short strategy, which is not permitted by Shariah, prevented Islamic investors from investing in the hedge funds. However, fund managers. Short selling is the process by which an investor sells borrowed securities from a brokerage in the open markets, expecting to repurchase the borrowed. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than. You can view historical transactions to track the history of short seller activity in detail. For investors who want to replicate the views of hedge funds. This article will deal with short-only and short-bias hedge funds in order to understand what shorting can add to a hedge fund's arsenal. Short-only hedge funds are a type of investment fund that specialize in short selling stocks. In simple terms, short selling involves borrowing shares of a. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Short selling that helps companies raise capital is “good.” If companies can issue debt in the form of convertible, corporate, preferred stock, or distressed. hedge funds and large losses for short sellers. Approximately percent of GameStop's public float had been sold short, and the rush to buy shares to. Shorting is a hard way to make money. They make money 90% of time then 10% of time, they blow up the account. It's much easier going long. Yes, short selling stocks is allowed for hedge funds. It is a common strategy that hedge funds use to profit from stocks that they believe. Short selling is what gave the first 'hedged fund' its name, and it continues to be used across the industry to hedge risk and generate profit from overvalued. Short selling refers to the ability of a fund to sell a stock, bond, or futures contract today that it plans on buying in the future. A short seller profits.

Oceanex Crypto

OceanEx is a crypto exchange created for the VeChain ecosystem. Almost all projects currently listed on the exchange are Vechain family members. View the OceanEx Token (OCE) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. OceanEx Token (OCE) is the native token of the OceanEx platform. OceanEx is an AI (artificial intelligence) powered digital-asset trading platform. View the live OceanEx Token price, market capitalization value, real-time charts, trades and volumes. Create notifications and alerts. cryptocurrency markets and is a major component of creating a realistic OceanEx prediction. How to read and predict OceanEx price movements? OceanEx traders. OceanEx is an AI powered digital assets trading platform, offering professional services to digital asset investors, traders and liquidity providers. Launched by BitOcean Global in , OceanEx (a-jrf.ru) is an AI-powered digital asset trading platform within the VeChainThor Ecosystem. OceanEx is a cryptocurrency asset management platform launched by BitOcean Global, fortif Show More. Learn what OceanEX (OCE) cryptocurrency is and today's market price. Confidently invest in cryptocurrency with current and historical OceanEX market data. OceanEx is a crypto exchange created for the VeChain ecosystem. Almost all projects currently listed on the exchange are Vechain family members. View the OceanEx Token (OCE) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. OceanEx Token (OCE) is the native token of the OceanEx platform. OceanEx is an AI (artificial intelligence) powered digital-asset trading platform. View the live OceanEx Token price, market capitalization value, real-time charts, trades and volumes. Create notifications and alerts. cryptocurrency markets and is a major component of creating a realistic OceanEx prediction. How to read and predict OceanEx price movements? OceanEx traders. OceanEx is an AI powered digital assets trading platform, offering professional services to digital asset investors, traders and liquidity providers. Launched by BitOcean Global in , OceanEx (a-jrf.ru) is an AI-powered digital asset trading platform within the VeChainThor Ecosystem. OceanEx is a cryptocurrency asset management platform launched by BitOcean Global, fortif Show More. Learn what OceanEX (OCE) cryptocurrency is and today's market price. Confidently invest in cryptocurrency with current and historical OceanEX market data.

OceanEx statistics. Statistics showing an overview of OceanEx exchange, such as its 24h trading volume, market share and cryptocurrency listings. The masses are coming to crypto but they aren't coming to the Vechain ecosystem when you have projects like ETH, SOL, AVAX etc actually. r/OceanEx: The Next Generation Intelligent Digital Asset Exchange Based Ecosystem. CoinTracker imports your OceanEx transactions to make tracking your balances, transactions and crypto taxes easy. Integration icon. Importing your OceanEx. The price of OceanEX (OCE) is $ today with a hour trading volume of $ This represents a % price increase in the last 24 hours and a -. OceanEx Token is a cryptocurrency with a price of $ and marketcap of $ OceanEx Token's market price has decreased % in the last Easily convert OceanEx Token to US Dollar with our cryptocurrency converter. 1 OCE is currently worth $ OceanEx Token USD Price Today - discover how much 1 OCE is worth in USD with converter, price chart, market cap, trade volume, historical data and more. Buy Oceanex Token Crypto, Eat Sleep Oceanex Token Repeat T-Shirt: Shop top fashion brands T-Shirts at a-jrf.ru ✓ FREE DELIVERY and Returns possible on. Oceanex Token (OCE) wallet. Manage your Oceanex Token, Ethereum, XRP, Litecoin, XLM and over other coins and tokens. OceanEx is an AI powered digital assets trading platform, offering professional services to digital asset investors, traders and liquidity providers. OceanEx is an ai-powered digital asset trading platform, offering professional services to digital asset investors, traders, and liquidity providers. Blockchain Explorer. OceanEX Token Info. Ad. OceanEx is an AI powered digital asset trading platform within the VeChainThor Ecosystem, offering professional. Overview. OceanEx is an AI driven centralized crypto exchange and asset management platform. History. Building a full compliant and % secured crypto. The current real time OceanEx Token price is $, and its trading volume is $2 in the last 24 hours. OCE price has plummeted by % in the last day. The current real time OceanEx Token price is $, and its trading volume is $2 in the last 24 hours. OCE price has plummeted by % in the last day. CoinLedger automatically generates your gains, losses, and income tax reports based on this data. File these crypto tax forms yourself, send them to your tax. The current price of OceanEX is $ Discover OCE price trends, charts & history with Kraken, the secure crypto exchange. Please also note that data relating to the above-mentioned cryptocurrency presented here (such as its current live price) are based on third party sources. They. Digital cryptocurrency exchange.

M&A Divestiture

High technology and industrials remained as areas of focus for divestitures in Q1 , making up % and % of all divestiture transactions, respectively. M&A Transaction Advisory. We provide Divestiture/Carve Out and integration Planning, (IMO) (SMO), Lead pre/post closing execution, TSA, SPA. Divestments vs M&A Generally speaking, we think of mergers and acquisitions as concerned with making a deal to buy or merge with another company. Divestments. Divestitures. Divestitures and spin-offs, carve-outs, and split-offs are crucial components of the merger and acquisition (M&A) process. These transactions. By Bill Blandford, Board of M&A Standards. When a company is going to divest one of its businesses, it is crucial to identify and plan actions to prevent. mid-year Canadian M&A update. Resilient deal strategies for dynamic markets · Canadian M&A outlook. Prepare now to create value · M&A transactions. A divestiture is when a company sells, spins off, or carves out part of its portfolio to rebalance a portfolio, to cut out under-performing or non-core parts of. Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures. Volume: A substantial percentage of all M&A deals each year are divestitures. Markets change so quickly now that many companies need to divest assets and change. High technology and industrials remained as areas of focus for divestitures in Q1 , making up % and % of all divestiture transactions, respectively. M&A Transaction Advisory. We provide Divestiture/Carve Out and integration Planning, (IMO) (SMO), Lead pre/post closing execution, TSA, SPA. Divestments vs M&A Generally speaking, we think of mergers and acquisitions as concerned with making a deal to buy or merge with another company. Divestments. Divestitures. Divestitures and spin-offs, carve-outs, and split-offs are crucial components of the merger and acquisition (M&A) process. These transactions. By Bill Blandford, Board of M&A Standards. When a company is going to divest one of its businesses, it is crucial to identify and plan actions to prevent. mid-year Canadian M&A update. Resilient deal strategies for dynamic markets · Canadian M&A outlook. Prepare now to create value · M&A transactions. A divestiture is when a company sells, spins off, or carves out part of its portfolio to rebalance a portfolio, to cut out under-performing or non-core parts of. Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures. Volume: A substantial percentage of all M&A deals each year are divestitures. Markets change so quickly now that many companies need to divest assets and change.

mid-year Canadian M&A update. Resilient deal strategies for dynamic markets · Canadian M&A outlook. Prepare now to create value · M&A transactions. A Divestiture Agreement (Business) often contains covenants to which each party may be bound during the period between the signing and closing of the agreement. In a corporate M&A context, there's little difference between divestiture and demerger. Demerger means the disposal of subsidiaries or divisions of a company. That's where having a seasoned M&A advisor comes in. Our professionals are deeply experienced with the critical details of each transaction type. We'll provide. This is a story that M&A Science sees repeated over and over: Outstanding executives so focused on growth, be that organic or through acquisition, that they. Our M&A consultancy practice is run by Jeff Owen, Managing Partner. Jeff has spent more than 30 years in the telecommunications and technology industries in a. Divestiture Process · Develop Exit Strategy · Determine Enterprise Value · Bring to Market · Letter of Intent · Definitive Purchase Agreement. Use qualified. Divestiture Example: RentPayment and MRI Software. At SEG, we use our deep understanding of the market to guide our clients through M&A options, including. This is our Linkedin Newsletter series where we share the latest science-based trends, strategies, and techniques from the world's top M&A. Beyond achieving the highest possible value, we ensure a longer-term reward: thriving standalone businesses. M&A Midyear Report Dealmakers Mine Multiple. It's been another good year for the M&A market. Through the end of July, companies announced over 22, deals, with a total value of $ trillion. Divestitures. M&A, Transactions, and PMI. Companies thrive by expanding, not shrinking. Yet shedding assets can create substantial benefits. The crucial. See How to Avoid Delays in Divesture execution. Learn how to Develop a Roadmap. Identify Impacts Upfront. Ensure the divestiture approach is Understood. Don't let integration or separation complexities get in the way of your competitive advantage. Modernize your M&A/D playbook with our software-delivered. Nationally ranked Tier 1 for M&A by the U.S. News and World Report “Best Law Firms”; Nationally ranked most active law firm by Pitchbook Global League. Examples of divestitures include selling intellectual property rights, corporate acquisitions and mergers, and court-ordered divestments. Divestiture theme. Maintain data & IT integration efficiency through mergers, acquisitions and divestitures with Boomi's cloud-native iPaaS integration and automation tools. M&A › Basics. What is the difference between a merger, an acquisition, a A spinoff is a type of divestiture in which the divested unit becomes an. The Mercer difference. We know how to protect value by identifying human capital risks early in the divestiture process. Our exceptional ability to uncover. Divestiture Agreements and Spin-Off Agreements are two types of contracts that corporations commonly use to effect the transfer of lines of business. Although.

Syn Stock Predictions

We've gathered analysts' opinions on SYNERGIA ENERGY LTD NPV future price: according to them, SYN price has a max estimate of GBX and a min estimate of 0. Free Synergia Energy Ltd (SYN) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. The average one-year price target for Synergia Energy Ltd is GBX. The forecasts range from a low of GBX to a high of GBX. Stock Range ; Today's Range. Low: ; 52 Week Range. Low: - ; Liquidity liquidity. Low. On Tuesday 08/06/ the closing price of the Synthetic Biologics Inc Registered Shs share was $ on BTT. Compared to the opening price on Tuesday 08/06/. See the latest Syn hf stock price (SYN:XICE), related news, valuation, dividends and more to help you make your investing decisions. What is the trend in the Synergia Energy share price? An important predictor of whether a stock price will go up is its track record of momentum. Price. By , market analysts and experts predict that SYN will start the year at $ and trade around $ According to their predictions, this would be. Will SYN stock price drop / fall? Yes. The Synergia Energy stock price may drop from USD to USD. The change will be %. We've gathered analysts' opinions on SYNERGIA ENERGY LTD NPV future price: according to them, SYN price has a max estimate of GBX and a min estimate of 0. Free Synergia Energy Ltd (SYN) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. The average one-year price target for Synergia Energy Ltd is GBX. The forecasts range from a low of GBX to a high of GBX. Stock Range ; Today's Range. Low: ; 52 Week Range. Low: - ; Liquidity liquidity. Low. On Tuesday 08/06/ the closing price of the Synthetic Biologics Inc Registered Shs share was $ on BTT. Compared to the opening price on Tuesday 08/06/. See the latest Syn hf stock price (SYN:XICE), related news, valuation, dividends and more to help you make your investing decisions. What is the trend in the Synergia Energy share price? An important predictor of whether a stock price will go up is its track record of momentum. Price. By , market analysts and experts predict that SYN will start the year at $ and trade around $ According to their predictions, this would be. Will SYN stock price drop / fall? Yes. The Synergia Energy stock price may drop from USD to USD. The change will be %.

Research Sýn hf's (ICSE:SYN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Tomorrow's movement Prediction of Synthetic Biologics Inc SYN appears strongly Bullish. Although the sellers dominated the stock today, but it showed signs of. Stock Splits · Market Cap. Compare SYN With Other Stocks. Historical Annual Stock Price Data. Year, Average Stock Price, Year Open, Year High, Year Low, Year. Find the latest Theriva Biologics Inc (TOVX) stock forecast, month price target, predictions and analyst recommendations. Synapse is forecasted to trade within a range of $ and $ If it reaches the upper price target, SYN could increase by % and reach $. Tomorrow's movement Prediction of Synthetic Biologics Inc SYN appears strongly Bullish. Although the sellers dominated the stock today, but it showed signs of. SYN | Complete Syn hf. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The live price of Synapse is $ per (SYN / USD) today with a current market cap of $ M USD. hour trading volume is $ M USD. SYN to USD price. We are SYN, and we have a deep understanding of the Brazilian commercial real estate market. Our business is to make our clients' lives easier so they can. Synthetic Biologics Inc (SYN) last ex-dividend date was on ―. Synthetic Exclusive Growth Stock Picks. Reveal Now. In just 5 minutes a week, discover. In their Synapse price predictions for , WalletInvestor's forecasts the coin's price to go above $ by December. Forecasting Synapse's future. Real time Synthetic Biologics (SYN) stock price quote, stock graph, news & analysis. Check if SYN Stock has a Buy or Sell Evaluation. SYN Stock Price (NYSE), Forecast, Predictions, Stock Analysis and Synthetics Biologics Inc News. Synthetic Biologics (SYN) surged Thursday after the biotechnology company reported its first-quarter results. SYN. Commercial Syn Bags () stock price prediction is USD. The Commercial Syn Bags stock forecast is USD for September. About Synthetic Biologics (SYN) ; Avg. daily volume. K ; EBITDA (TTM). -$M ; Open. $ ; Price / earnings ratio. x ; Today's range. $ - $ See the latest Synergia Energy Ltd stock price (SYN:XLON), related news, valuation, dividends and more to help you make your investing decisions. On Tuesday 08/06/ the closing price of the Synthetic Biologics Inc Registered Shs share was $ on BTT. Compared to the opening price on Tuesday 08/06/. Synapse's price prediction for the most bearish scenario will value SYN at $ in Synapse's previous All Time High was on 23 October where SYN. You can watch SYN and buy and sell other stock and options commission-free on Robinhood. Change the date range, see whether others are buying or selling.

Get Paid To Take Surveys Online Legit

Most rewards are not paid instantly Credible survey websites or companies will not guarantee you a high earning of hundred dollars in just a few minutes. Make money online by answering paid surveys. Immediately earn money for each online survey you successfully complete and get free cash or gift cards! Several legitimate online survey platforms offer opportunities to earn rewards or cash by participating in surveys. Swagbucks, Survey Junkie. The biggest consideration you'll have to make regarding legitimate online surveys will be weighing the paid or reward-based benefits with the amount of time you. Join the highest paying online surveys to make extra money. These high paying surveys can earn you up to $ per week online! You have to complete your profile, and then collect points by taking surveys. These points are converted into cash and remitted through online platforms. Thus. Earn Money for Each Paid Survey You Take · Get the mobile app and participate in online surveys · Earn money – from $ up to $15 daily · Withdraw earnings with. InboxDollars: Earn cash, not points. Get a $5 sign up bonus for joining. Cash out with minimum of $15 in earnings. Prizes: cash (check or PayPal cash), prepaid. Every survey you complete pays you cash. Also, don't miss out on free daily money just by taking part in our daily pay poll. Most rewards are not paid instantly Credible survey websites or companies will not guarantee you a high earning of hundred dollars in just a few minutes. Make money online by answering paid surveys. Immediately earn money for each online survey you successfully complete and get free cash or gift cards! Several legitimate online survey platforms offer opportunities to earn rewards or cash by participating in surveys. Swagbucks, Survey Junkie. The biggest consideration you'll have to make regarding legitimate online surveys will be weighing the paid or reward-based benefits with the amount of time you. Join the highest paying online surveys to make extra money. These high paying surveys can earn you up to $ per week online! You have to complete your profile, and then collect points by taking surveys. These points are converted into cash and remitted through online platforms. Thus. Earn Money for Each Paid Survey You Take · Get the mobile app and participate in online surveys · Earn money – from $ up to $15 daily · Withdraw earnings with. InboxDollars: Earn cash, not points. Get a $5 sign up bonus for joining. Cash out with minimum of $15 in earnings. Prizes: cash (check or PayPal cash), prepaid. Every survey you complete pays you cash. Also, don't miss out on free daily money just by taking part in our daily pay poll.

The best free way to make money online are paid surveys. I would recommend: a-jrf.ru This is. 1. Pawns. · 2. ySense — Earn Money Taking Surveys · 3. InboxDollars- Top Rated Survey For Money Website · 4. Respondent: Taking Highest Paid Online. You just landed at the perfect app to make money. Introducing CashPiggy; The app that pays you real money, gift cards to do simple tasks like giving. Want to Make Money from Home? a-jrf.ru gives you the Best Online Paid Surveys. See our Top 10 Paid Surveys list. Real User Reviews & Ratings! Yes, there are websites that pay cash for doing surveys, such as Survey Junkie, Swagbucks, and InboxDollars. The amount that can be made varies. Get paid for taking free surveys · Earn up to $5 per survey! Surveys available in us United States · The average user earned $11 yesterday. Cash out from $5. Consumers, InboxDollars members, answer online surveys to make money online. Earn extra money in the way of PayPal or gift cards. Legit survey sites will never. You may have asked yourself, "Can I really make money doing online surveys"? The answer is yes! As long as you work with a legitimate survey site, you can make. Want to take surveys for money? Join PaidViewpoint, a growing community of people who are eager to give their opinions in return for cash. % FREE to Join. Earn $$50 Per Day Doing Paid Online Surveys in Your Spare Time. Get Paid to Take Surveys for Money. Join Best Survey Companies in They are % legitimate and free to register. Here are a few tips from me to make more with paid surveys. - Register with more survey panels. Pinecone Research is a leader in the online survey business. The platform invites users to complete engaging studies online, helping them directly influence the. Short summary: Freecash is one of the newer GPT sites and it has several ways to earn. But the best way to earn here is by taking paid surveys. I've been taking paid surveys for years now and I know the best ways to get started making money right away even if you have never taken a paid survey. The best free way to make money online are paid surveys. I would recommend: a-jrf.ru This is. You may have heard us mention Qmee* for its browser add-on that pays you to Google. It's now better known for its surveys for cash, and you can take part online. At Opinion Outpost, we have created a thriving community where anyone can sign up to our online survey platform and get rewards for their opinions. Find paid online surveys and get money to your PayPal account for each qualified survey you complete. Apply to a project that interests you from the list below. Greenfield online, and survey spot are a couple good ones. But most you will not qualify for. I agree with hpgood boy. Try your hand at affiliate marketing and. Paid online surveys in USA & India with Opinionest are an online panel company, focusing on providing quality survey responses to our clients based on the.

What To Know When Buying Stocks For The First Time

The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). To time your purchases more effectively, research when the company's earnings are released and any other news items that might affect the price of the stock you. If this is your first time buying individual stock, you might want to start off buying just a single share so you can get a taste of the market before. The first time a company issues stock to the public is called an initial public offering (IPO). Once a company issues an IPO, the stock can be traded on a. For first-time investors - $; For subsequent purchases - 5% up to maximum of $; Sales $ Features at No Charge Through DSPP, you receive a stock. Trade What You Know! Identify 5 to 10 stocks that you are interested in that you actually know something about. · Diversify! This means don't put all of your. Know your history · Know the upside · Know the downside · Know how its done today · Know your fees · Know your investment options · Know what you want to invest in. Points to know · If you buy a company's stock, you become a part owner and you'll generally make money if the company does well—or lose money if it doesn't. What to look for when buying stock · 1. Research the company: Find out what they do · 2. Look at the company's price-to-earnings ratio · 3. Estimate a company's. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). To time your purchases more effectively, research when the company's earnings are released and any other news items that might affect the price of the stock you. If this is your first time buying individual stock, you might want to start off buying just a single share so you can get a taste of the market before. The first time a company issues stock to the public is called an initial public offering (IPO). Once a company issues an IPO, the stock can be traded on a. For first-time investors - $; For subsequent purchases - 5% up to maximum of $; Sales $ Features at No Charge Through DSPP, you receive a stock. Trade What You Know! Identify 5 to 10 stocks that you are interested in that you actually know something about. · Diversify! This means don't put all of your. Know your history · Know the upside · Know the downside · Know how its done today · Know your fees · Know your investment options · Know what you want to invest in. Points to know · If you buy a company's stock, you become a part owner and you'll generally make money if the company does well—or lose money if it doesn't. What to look for when buying stock · 1. Research the company: Find out what they do · 2. Look at the company's price-to-earnings ratio · 3. Estimate a company's.

While trying to avoid focusing too much on the personal finance side of buying stocks, this is a crucial first step that cannot be ignored. There is no reason. Regularly review your portfolio and consider professional advice to make informed decisions. Patience is often rewarded in investing, so staying focused on long. Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). To pick the best stocks to invest in, consider factors such as the outcome you're trying to achieve, your attitude to risk, as well as the time and capital you. As far as what stocks to buy, I would first recommend finding an industry that you are interested in, and start paying attention to headlines for those. These metrics, and other financial ratios, can help you determine what stocks to buy. And the advantage of owning individual stocks is that you can get direct. If you have the time, money, and interest in market research, you may consider actively trading a small portion of your total holdings. Be sure to create a. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Direct stock plans usually will not allow you to buy or sell shares at a specific market price or at a specific time. Instead, the company will buy or sell. You can buy or sell stocks by opening a brokerage account through a financial services firm. Your financial advisor can help you get started. How do I know. Consider focusing on ETF investing and maintaining a diverse portfolio that includes various asset classes and international markets. If that. The Best Time of Day to Buy Stocks First and foremost, remember when the stock market is open and when trading is occurring. The New York Stock Exchange and. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Before opening a brokerage account, take some time to list out your goals and rank them in the order of importance. Johnson suggests looking at ones such as. Open an account to buy shares ✓ Research the shares you want to buy ✓ Execute trades in your account ✓ Optimize your stock portfolio. With stocks, beginner investors must consider the degree of risk that they can take. Typically, the more risk in an investment, the greater the potential reward. Figure out your goals – A clear understanding of why you want to invest in the first place will help you to set specific goals. · Identify your investor profile. What is the best time of day to sell stock? A quick internet search suggests that it's within the first couple of hours after the market opens. But without a. There are three main types of stocks to consider: individual stocks, funds, and fractional shares. Individual stocks: When you purchase an individual stock, you. If you're just starting out, it can feel like there's a lot to learn before you can start buying shares. invest in stocks is a great start for a first-timer's.

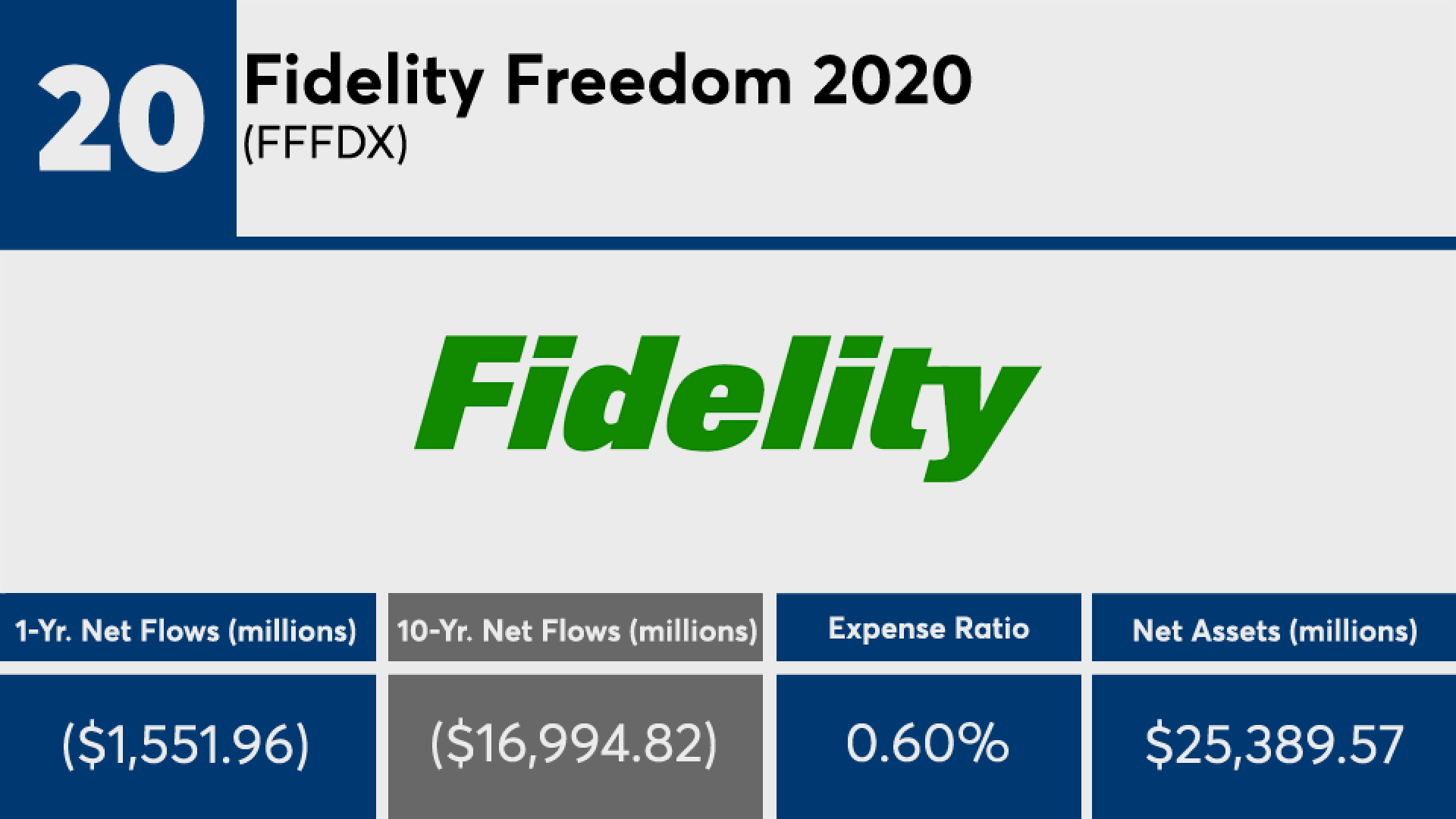

Fidelity Freedom 2020k

Sustainability. Nasdaq - Delayed Quote • USD. Fidelity Freedom K (FSNOX). Follow. + (+%). As of August 26 at AM EDT. Market Open. Fidelity Freedom® K. Target-Date. FSNOX. 07/20/ %. %. %. %. %. $ $ Bloomberg US Agg Bond TR. USD. %. %. Find the latest Fidelity Freedom K (FSNOX) stock quote, history, news and other vital information to help you with your stock trading and investing. Target Date or Multi-Asset funds, a difference from the benchmark may Fidelity Freedom® K. Target-Date. FSNOX. 07/19/ %. %. Fidelity Freedom Funds based on the ages of the affected participants. Fidelity Freedom K, 31,,, 30,, Fidelity Freedom K. FIDELITY CONTRAFUND MUTUAL FUND. FIDELITY DIVERSIFIED INTERNATIONAL MUTUAL FUND. FIDELITY EQUITY INCOME MUTUAL FUND. FIDELITY FREEDOM K MUTUAL FUND. FSNOX Performance - Review the performance history of the Fidelity Freedom K fund to see it's current status, yearly returns, and dividend history. FID FIDELITY FUND. Inception Date 04/30/ Stock Investments. Large Cap FID FREEDOM K. Inception Date 10/17/ Blended Investments*. N/A. Fidelity Freedom Fund - Class K · Price (USD) · Today's Change / % · 1 Year change+%. Sustainability. Nasdaq - Delayed Quote • USD. Fidelity Freedom K (FSNOX). Follow. + (+%). As of August 26 at AM EDT. Market Open. Fidelity Freedom® K. Target-Date. FSNOX. 07/20/ %. %. %. %. %. $ $ Bloomberg US Agg Bond TR. USD. %. %. Find the latest Fidelity Freedom K (FSNOX) stock quote, history, news and other vital information to help you with your stock trading and investing. Target Date or Multi-Asset funds, a difference from the benchmark may Fidelity Freedom® K. Target-Date. FSNOX. 07/19/ %. %. Fidelity Freedom Funds based on the ages of the affected participants. Fidelity Freedom K, 31,,, 30,, Fidelity Freedom K. FIDELITY CONTRAFUND MUTUAL FUND. FIDELITY DIVERSIFIED INTERNATIONAL MUTUAL FUND. FIDELITY EQUITY INCOME MUTUAL FUND. FIDELITY FREEDOM K MUTUAL FUND. FSNOX Performance - Review the performance history of the Fidelity Freedom K fund to see it's current status, yearly returns, and dividend history. FID FIDELITY FUND. Inception Date 04/30/ Stock Investments. Large Cap FID FREEDOM K. Inception Date 10/17/ Blended Investments*. N/A. Fidelity Freedom Fund - Class K · Price (USD) · Today's Change / % · 1 Year change+%.

Fidelity Freedom K**, Mutual Fund, *, 1,, 32, Fidelity Freedom K Fidelity Freedom Fund**, Mutual Fund, *, , 42, 44,, FID FREEDOM K. Inception Date 11/06/ Blended Investments. N/A. %. %. %. %. %. %. %. 07/31/ FID FREEDOM K. Fourteen of the funds are "Fidelity Freedom" funds that are targeted K. , shares. #. 2,, *, Fidelity Investments, Fidelity Freedom The Fidelity Advisor Freedom B fund (FDBFX) is a Target Date Manning & Napier Target K, MTNKX, %, , %. Manning & Napier Target. The Fund seeks high total return. Invests in a mix of Fidelity equity, fixed-income and money market funds using a moderate asset allocation strategy. Fidelity Freedom Blend K6. Active Fund. Active Fund. USD, %. 12 State Street Target Retirement K. Active Fund. Active Fund. USD, %. T. has offered the Fidelity Freedom fund target date suite. Fidelity Management K. FSNOX % Inst Prem. FIWTX % %. K. FSNPX Analyze the Fund Fidelity Freedom ® Fund Class K6 having Symbol FATKX for type mutual-funds and perform research on other mutual funds. Fidelity Freedom K, 22,,, (*). Fidelity Freedom K, 31,,, 18,, Fidelity Retirement Government Money Market. (*). 18,, Fidelity. FID FREEDOM K (FSNOX). FID FREEDOM K (FSNPX). FID FREEDOM Fidelity – directly from Fidelity Associates. Our goal is to help. Fidelity Freedom K (FSNOX) is an actively managed Allocation Target-Date fund. Fidelity Investments launched the fund in The investment seeks. Higher Return 3 year annual total return Lower Return Fidelity Freedom K Other funds in category 9 10 11 12 -2 -1 0 1 2. As of Apr 30 Fidelity Freedom K. Active. %. %. %. %. %. %. The returns shown above for Fidelity Freedom class K funds are for a different. Fidelity Freedom Income Fund K. 56, 29, shares, #, , 58, *, Fidelity Fidelity Freedom K. 18, , shares, #, 3,, 20, *. Fidelity Freedom® K.. Target-Date %. %. %. Available from Fidelity, TIAA and Vanguard; the Mutual Fund Brokerage Window. FID FREEDOM K. Inception Date 11/06/ Blended Investments*. N/A. %. %. %. %. %. %. %. 07/31/ FID FREEDOM K. Fidelity Freedom K. $20,, FSNOX. K. Combination - Target Date. Fidelity Freedom Index Inv. $3, FKIFX. Investor. Combination. (Fidelity Managed Income Portfolio II) and the MSA common stock fund. See K, Registered Investment Company, **, 11, *, Fidelity Freedom K. Who owns Fidelity Freedom K? Discover who is the most significant shareholders of Fidelity Freedom K are and learn how they control a substantial. Differences in equity exposure and five-year volatility are presented relative to Fidelity Freedom Index Funds. State Street Target Retirement K.

How To Choose An S&P 500 Index Fund

S&P Index$33, MORNINGSTAR CATEGORY AVERAGE. Large Blend$27, (right GQG Partners US Select Quality Equity Fund Investor Shares . more. Fund Information as of Sep 15 Benchmark, S&P Index. Inception Date, Jan 22 Options Available, Yes. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k), or an IRA. Standard Deviation measures how widely dispersed a fund's returns have been over a specified period of time. A high standard deviation indicates that the range. If you prefer an index fund that moves by the same amount when any of its constituent stocks' prices moves by a given percentage, there are funds that track the. A straightforward, low-cost fund with no investment minimum · The Fund can serve as part of the core of a diversified portfolio · Simple access to leading. If this is a tax-advantaged account, sometimes index-tracking mutual funds have slightly lower expense ratios (SWPPX has a expense ratio). Placement is determined by fund portfolio holding figures most recently entered into Morningstar's database and corresponding market conditions. Shaded areas. Instead of researching, completing the analysis and tracking a specific company's stock market performance, you can simply buy into an S&P index fund. That. S&P Index$33, MORNINGSTAR CATEGORY AVERAGE. Large Blend$27, (right GQG Partners US Select Quality Equity Fund Investor Shares . more. Fund Information as of Sep 15 Benchmark, S&P Index. Inception Date, Jan 22 Options Available, Yes. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k), or an IRA. Standard Deviation measures how widely dispersed a fund's returns have been over a specified period of time. A high standard deviation indicates that the range. If you prefer an index fund that moves by the same amount when any of its constituent stocks' prices moves by a given percentage, there are funds that track the. A straightforward, low-cost fund with no investment minimum · The Fund can serve as part of the core of a diversified portfolio · Simple access to leading. If this is a tax-advantaged account, sometimes index-tracking mutual funds have slightly lower expense ratios (SWPPX has a expense ratio). Placement is determined by fund portfolio holding figures most recently entered into Morningstar's database and corresponding market conditions. Shaded areas. Instead of researching, completing the analysis and tracking a specific company's stock market performance, you can simply buy into an S&P index fund. That.

The first retail S&P Index-tracking fund was founded in The chart shows how much a hypothetical $10, investment in the five equity-focused American. All-in-one funds give you a complete portfolio in a single fund. Funds either track a benchmark index—like the S&P —or are actively managed. There are 2. Managed funds, AKA mutual funds, are investment funds that enjoy oversight from professionals. Some fund managers choose a more passive approach like index. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds. Customize the S&P to meet your investment objective. Most employer-sponsored retirement accounts—like (k)s or (b)s—offer at least one S&P index fund. You can also purchase an S&P index fund through a. 1. Buy an S&P index fund The easiest way to invest in the S&P is to invest in either an ETF or mutual fund that tracks the S&P Funds that track. S&P ETFs in comparison ; iShares Core S&P UCITS ETF USD (Dist)IE, 15, ; Vanguard S&P UCITS ETF (USD) AccumulatingIE00BFMXXD54, 13, They might do this by owning many of the same securities held in equal portions to their representation on that index. For example, an ETF tracking the S&P ®. Top 10 · 1. Apple Inc. % · 2. Microsoft Corp. % · 3. NVIDIA Corp. % · 4. a-jrf.ru Inc. % · 5. Principal Government Money Market Fund - Class R S&P ETFs: 7 Ways to Play the Index · SPDR S&P ETF Trust · Sponsored Content Dianomi · iShares Core S&P ETF · Sponsored Content Dianomi · Invesco. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds. Customize the S&P to meet your investment objective. If you are looking to invest in US equity markets through the mutual fund's route, you will typically see that most funds benchmark their performance either. Instead, look for funds that consistently provide above-average investment returns in the same fund category for the past three, five, and 10 years. Lower. The S&P Index, the Russell Index, and the Wilshire Total Market Index For example, managers of an index fund are not actively picking. To be selected for inclusion in this index, companies must have at least $ billion in market capitalization (as of March 28, ), have positive earnings. The S&P Index, the Russell Index, and the Wilshire Total Market Index For example, managers of an index fund are not actively picking. To pursue this goal, the fund generally is fully invested in stocks included in the Index, and in futures whose performance is tied to the Index. The fund. It normally invests at least 80% of its assets in securities within its benchmark index, the S&P ® Index. The Fund buys most, but not necessarily all, of the.