a-jrf.ru

Recently Added

What Is Cost Of Extended Car Warranty

An extended warranty offers the owner extra coverage for a longer period of time or for more mileage. “Warranty” in this context is really a misnomer; the. Every year the cost of vehicle repairs continues to climb as vehicle complexity increases. The average cost of a single repair ranges from $ to $ dollars. Take $ a month for the length of the extended warranty and invest it. If your engine blows up after 3 years, take the $ which has now. An extended auto warranty protects you from costs associated with a mechanical breakdown. It covers unforeseen repairs on various systems and components, from. Not sure whether or not to purchase an extended warranty for your car. You will have a few options, so before you decide, know what car parts are covered. We've put together a simple guide to help you understand what an AA Extended Warranty could cost. You can also click through to get a tailored quote for your. What Are Extended Warranties? · Service contracts cost extra, typically $1, - $2,, depending on the length and type of coverage. · Future repair costs are. The first extended warranty monthly subscription for Canadians. Starting at $/month. No commitment, no paperwork. % online. You can buy an extended car warranty from your dealer or car manufacturer when you purchase a new car or any time before the car's standard warranty expires. An extended warranty offers the owner extra coverage for a longer period of time or for more mileage. “Warranty” in this context is really a misnomer; the. Every year the cost of vehicle repairs continues to climb as vehicle complexity increases. The average cost of a single repair ranges from $ to $ dollars. Take $ a month for the length of the extended warranty and invest it. If your engine blows up after 3 years, take the $ which has now. An extended auto warranty protects you from costs associated with a mechanical breakdown. It covers unforeseen repairs on various systems and components, from. Not sure whether or not to purchase an extended warranty for your car. You will have a few options, so before you decide, know what car parts are covered. We've put together a simple guide to help you understand what an AA Extended Warranty could cost. You can also click through to get a tailored quote for your. What Are Extended Warranties? · Service contracts cost extra, typically $1, - $2,, depending on the length and type of coverage. · Future repair costs are. The first extended warranty monthly subscription for Canadians. Starting at $/month. No commitment, no paperwork. % online. You can buy an extended car warranty from your dealer or car manufacturer when you purchase a new car or any time before the car's standard warranty expires.

The extended warranties are transferable to the vehicle's next owner (or dealership, should you be trading it in). You can advertise it as a bonus when ready to. But make sure you can buy them up till the last day of normal coverage and that they do cover most if not all types of failures: wiring, electrical, power train. Zero, nada, zilch. Extended warranties are a complete waste of cash, regardless of the cost. Save your hard earned cash for general service and maintenance. Summary: Extended car warranties, also known as vehicle service contracts (VSCs), can give car buyers additional coverage beyond the factory warranty. In contrast, extended warranties cost an average of $ per year — a difference of $ However, the average total cost of an extended warranty is $2, Although it may depend on the area you live in, the vehicle you are looking to cover, and the coverage package level you choose, the average driver in the. The extended warranty—also known as a service contract or a service agreement—typically helps to offset repair costs once the manufacturer warranty has ended. An extended warranty plan can cover the cost of repairs for as long as you own your car. There is no law requiring extended vehicle coverage, but there is a. The average annual cost of an extended vehicle warranty ranges from $1, to $3, a year, depending on several factors, including the type of warranty, the. Legally, “extended warranties” are not warranties, instead they're service contracts that promise to pay for repairs—and they do cost extra. They are usually. Extended warranties cost extra and for a percentage of the item's retail price. ^ "Should I buy a third-party extended warranty for my car?". The Globe and. If your engine blows up after 3 years, take the $ which has now doubled to $ and put it towards the engine or a new car. Insurance, home. Extended warranties cost extra and for a percentage of the item's retail price. ^ "Should I buy a third-party extended warranty for my car?". The Globe and. How Much Does an Extended Warranty Cost? Extended car warranties can cost between about $1, and $5,, depending on several factors. They include. The average annual cost of an extended vehicle warranty ranges from $1, to $3, a year, depending on several factors, including the type of warranty, the. So, for this particular truck we're discussing, the warranty will cost the Dealer between $ and $1, - or % and %. That's what he or she will pay the. An extended car warranty is an agreement with a vehicle services contract provider that covers the cost of certain repairs. You pay an up-front or monthly fee. Extended warranties can be offered by a motor vehicle dealer during, and sometimes even after, a vehicle has been purchased. If you're buying a vehicle from a. Legally, “extended warranties” are not warranties, instead they're service contracts that promise to pay for repairs—and they do cost extra. They are usually.

Where Do You Buy Treasury Bills

Go to your TreasuryDirect account. Choose BuyDirect. Choose whether you want EE bonds or I bonds, and then click Submit. Fill out the rest of the information. T-bills are generally considered a safe investment since they're backed by the U.S. government. To purchase a treasury bill, you can either buy it directly. Key Takeaways. TreasuryDirect allows investors to buy Treasury bonds and bills directly from the U.S. government. Members of the public wishing to purchase Treasury bills at the Treasury bill Primary Participants and purchase a minimum of £, nominal of bills. The first method is through a primary market. Here, investors buy T-Bills directly from the CBN and the minimum investment amount is ₦50,, Also, primary. Treasury bills can be bought and sold at the Domestic Market Operations department of the Central Bank of Trinidad & Tobago. Additionally, investors are free to. Log on to your TreasuryDirect account · Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities · TreasuryDirect. The primary market is an auction on the TreasuryDirect site to purchase the bills directly from the government. Bidders can include individual investors, banks. You can buy Treasury Bills, Notes, Bonds, TIPS, or FRNs at one of the auctions we conduct, or in the secondary market. If you want to buy a Treasury security at. Go to your TreasuryDirect account. Choose BuyDirect. Choose whether you want EE bonds or I bonds, and then click Submit. Fill out the rest of the information. T-bills are generally considered a safe investment since they're backed by the U.S. government. To purchase a treasury bill, you can either buy it directly. Key Takeaways. TreasuryDirect allows investors to buy Treasury bonds and bills directly from the U.S. government. Members of the public wishing to purchase Treasury bills at the Treasury bill Primary Participants and purchase a minimum of £, nominal of bills. The first method is through a primary market. Here, investors buy T-Bills directly from the CBN and the minimum investment amount is ₦50,, Also, primary. Treasury bills can be bought and sold at the Domestic Market Operations department of the Central Bank of Trinidad & Tobago. Additionally, investors are free to. Log on to your TreasuryDirect account · Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities · TreasuryDirect. The primary market is an auction on the TreasuryDirect site to purchase the bills directly from the government. Bidders can include individual investors, banks. You can buy Treasury Bills, Notes, Bonds, TIPS, or FRNs at one of the auctions we conduct, or in the secondary market. If you want to buy a Treasury security at.

You will need to contact the tastytrade trade desk to purchase bills, bonds, or notes. If you have the CUSIP please be ready to give it to us so we can get the. Short-term tradable government debt securities that investors buy at a discount. Maturity: 6 months or 1 year. Treasury bonds, also known as T-bonds or Treasurys, are viewed as safer than stocks, cryptocurrency and exchange-traded funds, or ETFs, because they are backed. Which securities may I reinvest in Treasury Direct? You may reinvest bills, notes, bonds, or FRNs, but not TIPS. Will I always get the same type and term? Investors considering Treasury securities have opportunities to buy bonds both at regularly scheduled auctions (see Auction Schedule) and in the secondary. Treasury bills/ bonds can be purchased at any time from the secondary market through primary dealers (PDs) or licensed banks. Primary dealers are appointed by. How To Buy Treasury Bills · Gather the following information: Your Social Security number (SSN) or taxpayer identification number (TIN), a U.S. address, and. Eligible investors.: Resident Bangladeshi individuals and institutions including banks, non-bank financial institutions, insurance companies etc. can purchase. You can also buy new-issues directly from the US government by opening an account at TreasuryDirect. The minimum purchase is $, with incremental purchases of. If you're looking for the easiest, no effort, buy and sell any time, no restrictions, no thought, check out an ETF like SGOV, USFR. No, Vanguard Fixed Income Trading does not offer I-bonds; I-bonds are savings bonds and cannot be purchased at Vanguard. No brokerage firm can offer savings. It is never less than %. See Interest rates of recent bond auctions. Interest paid, Every six months until maturity. Minimum purchase, $ In increments. Investors can buy or sell Treasury Bills on the secondary market from market makers, such as Retail and Investment Banks. These institutions would charge a bid/. We know you can buy Treasuries at any bank, but at Edward Jones you won't just be sent on your merry way with a deposit receipt and a bond certificate. We'll. Read Transcript Open new window Discover how to research and buy Treasuries in just a few simple steps. Treasury bills/ bonds can be purchased at any time from the secondary market through primary dealers (PDs) or licensed banks. Primary dealers are appointed by. Daily Treasury Bill Rates. Get updates to this content · NOTICE: See Developer Notice on changes to the XML data feeds. View the. You can purchase treasury bonds at auction or the secondary market through any of the major brokers including Fidelity, Schwab, or Vanguard. It. The minimum face value purchase for Treasury bills and bonds is Kshs. 50, for non-competitive bids and Kshs. 2,, for competitive bids, and.

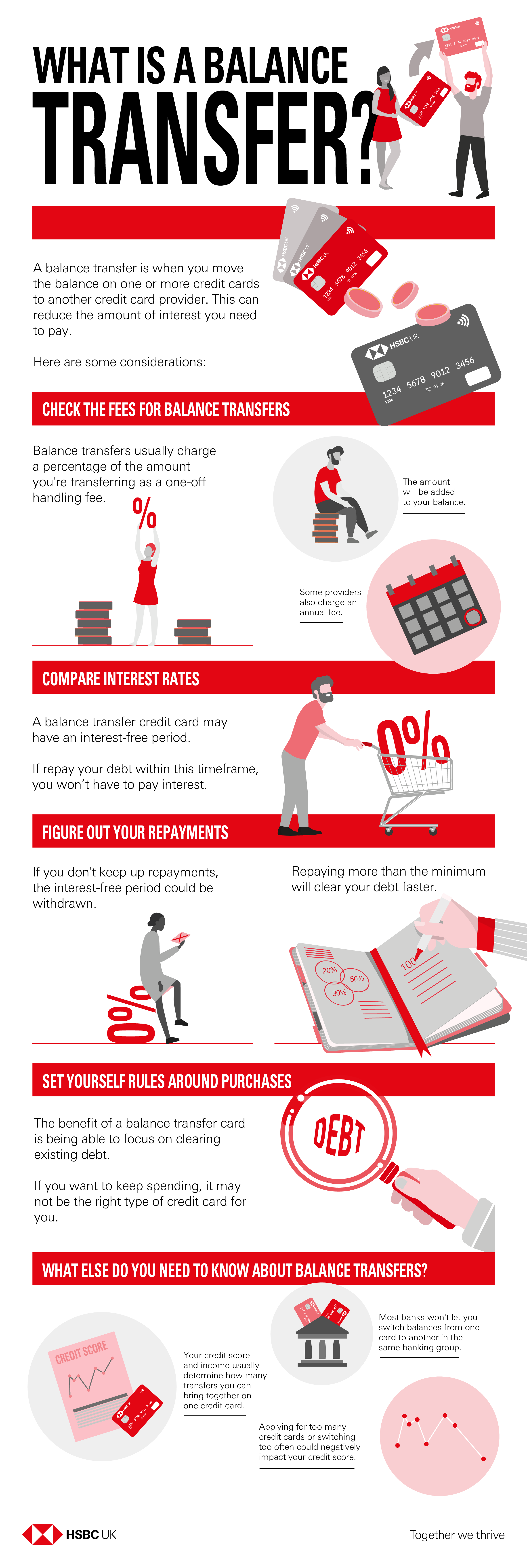

Is It Okay To Transfer Credit Card Balances

Citi® Diamond Preferred® Card · Citi Rewards+® Card · Wells Fargo Reflect® Card · Citi Double Cash® Card · Citi Simplicity® Card · Best in 0% Introductory APR and. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. Balance transfers offer far more pros than cons. From saving gobs on interest to saving your credit score, here are some of the highlights. A balance transfer allows you to take existing balances from one or more credit card accounts and transfer that debt to a new credit card with a lower interest. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. If you're working through a debt repayment plan, a credit card balance transfer can simplify your efforts. Instead of tracking multiple payments and interest. However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges. Of course, that depends on. If your debt is spread across multiple accounts, a balance transfer can also make your credit card payments more efficient. Once you consolidate your debt onto. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money. Citi® Diamond Preferred® Card · Citi Rewards+® Card · Wells Fargo Reflect® Card · Citi Double Cash® Card · Citi Simplicity® Card · Best in 0% Introductory APR and. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. Balance transfers offer far more pros than cons. From saving gobs on interest to saving your credit score, here are some of the highlights. A balance transfer allows you to take existing balances from one or more credit card accounts and transfer that debt to a new credit card with a lower interest. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. If you're working through a debt repayment plan, a credit card balance transfer can simplify your efforts. Instead of tracking multiple payments and interest. However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges. Of course, that depends on. If your debt is spread across multiple accounts, a balance transfer can also make your credit card payments more efficient. Once you consolidate your debt onto. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money.

A balance transfer is a good idea if you're able to reduce the amount you pay on interest and can avoid succumbing to excessive fees. It's a good idea for those. Balance transfers are one way to consolidate credit card debt. They allow borrowers to move existing balances to another credit card account, ideally one. Apply for the balance transfer credit card you have chosen. · Gather all the information on the debt you are going to transfer including account information. A balance transfer involves transferring high-interest credit card debt to a new card offering an intro 0% APR period, typically 12 to 21 months. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. Simply transferring a balance to an existing card won't affect your score. But using your card responsibly—by making on-time payments and paying down the. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. A joint balance transfer is when a balance is transferred to relieve a partner's debt. Not all credit card providers allow this, but there are several that give. A balance transfer credit card and a personal loan are both good options if you're struggling to pay off debt. A balance transfer credit card is best for. Again, done correctly, a big benefit of credit card balance transfer can be a significant savings on interest. Most importantly, carefully read the full terms. Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. Basically, a balance transfer is when you repay the money you owe on one credit card with a new lower-interest rate credit card. While transferring your balance. Keeping your credit card balance under control can be a challenge, but a balance transfer provides a smart way to consolidate and get rid of debt. You can keep transferring credit card balances as long as you're able to qualify for a good deal. But it's best to use the transaction to save money and get out. Pros and cons of balance transfer · Manage all your card balances in one place. · Pay less interest each month on what you currently owe – most balance transfers. You have an offer to transfer that balance to a card with a generous 0% intro/introductory APR for 18 months with a 3% balance transfer fee. With the same $ It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. A credit card balance transfer is the process of moving your balance from a high-interest credit card to a new credit card with a lower interest rate. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers.

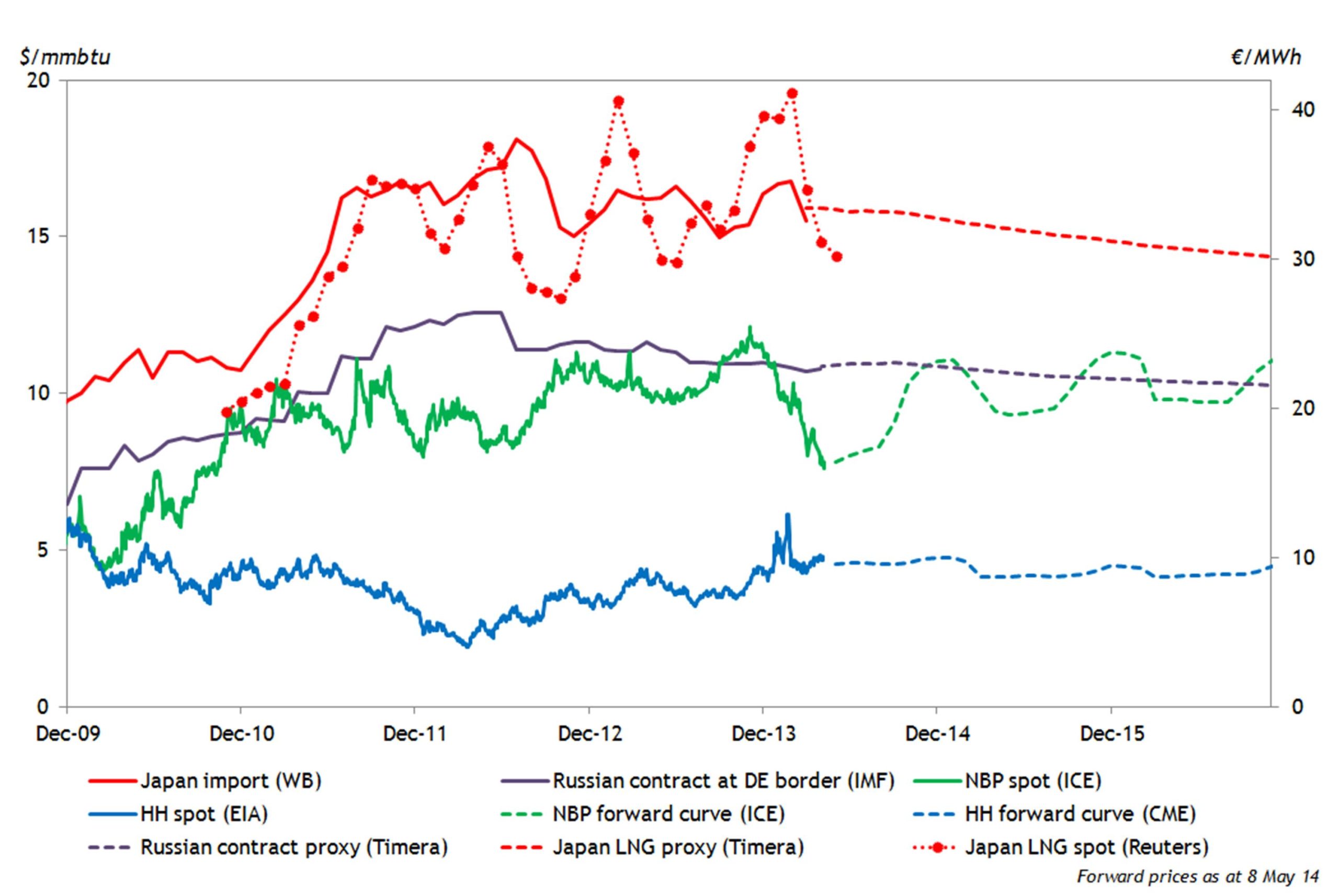

Gas Price Statistics

Graph and download economic data for US Regular All Formulations Gas Price (GASREGW) from to about gas, commodities, and USA. The California Statewide Fuel Price Index is determined each month on or about the first business day of the following month by using the posted monthly average. US Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last week and. California Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last. U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon). Year, Jan, Feb, Mar, Apr, May, Jun, Jul U.S. Gasoline and Diesel Retail Prices. The primary factors impacting gasoline prices are global crude oil cost (50%), refining costs (25%), distribution and marketing costs (11%) and federal & state. New York Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last. Average Retail Fuel Prices in the United States ; Gasoline, , ; E85, , ; CNG, , ; LNG ; Propane*, , National average gas prices ; Current Avg. $, $ ; Yesterday Avg. $, $ ; Week Ago Avg. $, $ ; Month Ago Avg. $, $ Graph and download economic data for US Regular All Formulations Gas Price (GASREGW) from to about gas, commodities, and USA. The California Statewide Fuel Price Index is determined each month on or about the first business day of the following month by using the posted monthly average. US Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last week and. California Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last. U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon). Year, Jan, Feb, Mar, Apr, May, Jun, Jul U.S. Gasoline and Diesel Retail Prices. The primary factors impacting gasoline prices are global crude oil cost (50%), refining costs (25%), distribution and marketing costs (11%) and federal & state. New York Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last. Average Retail Fuel Prices in the United States ; Gasoline, , ; E85, , ; CNG, , ; LNG ; Propane*, , National average gas prices ; Current Avg. $, $ ; Yesterday Avg. $, $ ; Week Ago Avg. $, $ ; Month Ago Avg. $, $

U.S. gas prices · Regular unleaded: $ · Mid-grade: $ · Premium: $ · Diesel: $ · E $ The Authoritative Voice On Pump Prices ; · from Yesterday's Avg* of $ ; · from Last Week's Avg* of $ ; · from Last Month's Avg* of $ ; Average global prices of oil, natural gas and coal, measured as an energy index where prices in = Latest Surveyed Regular Grade Motor Gasoline Prices ; New York Statewide, ; Upstate New York, ; Downstate New York, ; New York City Metropolitan. U.S. Regular Gasoline Prices*(dollars per gallon) full history XLS. Change from. 08/05/24, 08/12/24, 08/19/24, week ago, year ago. U.S., , , US Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last week. Gas prices can be volatile, fluctuating from month to month. In July, the average price for a gallon of gasoline was $, representing an increase of %. Average consumer prices are calculated for household fuel, motor fuel, and food items from prices collected for the Consumer Price Index (CPI). Average prices. Fuel Price Index ; 11/03/, , ; 10/27/, , ; 10/20/, , ; 10/13/, , Today's average state price can be found in the State Gas Prices report. line chart showing Average Monthly Retail Nebraska Midgrade Gasoline Prices. Gasoline - data, forecasts, historical chart - was last updated on August 24 of Gasoline increased USD/GAL or % since the beginning of This graph shows the trend of actual and inflation-adjusted gasoline prices from to There were gasoline price spikes in 19caused by the. California average gas prices ; Current Avg. $, $ ; Yesterday Avg. $, $ ; Week Ago Avg. $, $ ; Month Ago Avg. $, $ The EU average price — a weighted average using the most recent (year ) data for natural gas consumption by non-household consumers — was € per KWh. Likewise, the average residential price for the United States was obtained by dividing total residential revenues in the United States by total Interactive chart illustrating the history of Henry Hub natural gas prices. The prices shown are in U.S. dollars. The current price of natural gas as of August. Since data for Washington have been available, gas prices have been consistently higher in Washington state than the United States as a whole. The average price. It is not exactly a secret that the price of gas has gone up significantly during the past year. During the summer of , the price of gas in the United. fuel type and the price in cents per litre Related information. Replaces. The Consumer Price Index. Source (Surveys and statistical programs). Historical Prices for Natural Gas (Henry Hub) ; 08/20/24, , , , ; 08/19/24, , , ,

How Much Is S&P 500 Stock

The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products. Best S&P index funds. The S&P is one of the most widely-followed stock market indices in the world and there are many funds that invest based on the. 55 minutes ago. View S&P index (SPX) price today, market news, streaming charts, forecasts and financial information from FX Empire. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. Frequently Asked Questions · What is S&P Index value today? The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily, weekly or monthly format back to when S&P stock was issued. The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products. Best S&P index funds. The S&P is one of the most widely-followed stock market indices in the world and there are many funds that invest based on the. 55 minutes ago. View S&P index (SPX) price today, market news, streaming charts, forecasts and financial information from FX Empire. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. Frequently Asked Questions · What is S&P Index value today? The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily, weekly or monthly format back to when S&P stock was issued.

It is a market value weighted index made up of the prices of large stocks traded in the US market. You can find more information by going to one of the. The S&P ® Value measures constituents from the S&P that are classified as value stocks based on three factors: the ratios of book value, earnings and. S&P Index ; Open 5, ; Day Range 5, - 5, ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. %. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. KEY U.S., LAST, CHG, % CHG. DJIA, , , %. Nasdaq Composite, , , %. S&P , , , %. View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information. USX ; Real-time USA pm EDT, After hours pm ; 5, · +%, Intraday chart for S&P Price. 5, · Open Price. 5, · Day Range. 5, – 5, · Year Range. 4, – 5, · Constituent Total Market Cap. Tril. The S&P is a stock market index maintained by S&P Dow Jones Indices. It comprises common stocks which are issued by large-cap companies traded. Stock Market News Today, 8/30/24 – Indices Rally as Inflation Continues to price and activity for your symbols on the My Quotes of a-jrf.ru S&P Index ; 12 Month Change. % ; Day Range5, - 5, ; 52 Wk Range4, - 5, ; Total Components ; Components Up Since this is a price index and not a total return index, the S&P index here does not contain dividends. Copyright © , S&P Dow Jones Indices LLC. Interactive chart of the S&P stock market index over the last 10 years. Values shown are daily closing prices. The most recent value is updated on an. The S&P is one of the most important indices in the world as it widely tracks how the United States stock market is performing. The S&P has had several. Previous Close5, Day's Range5, - 5, ; 1 Year Price Returns%. Year to Date Price Returns% ; Number of Constituents · Total Market. S&P ETF Components ; 1, Apple Inc. AAPL ; 2, Microsoft Corp · MSFT ; 3, Nvidia Corp · NVDA ; 4, a-jrf.ru Inc · AMZN. Price Performance ; 6-Month. 4, +%. on 04/19/ Period Open: 5, 5, %. on 07/16/ + (+%). since 02/29/24 ; YTD. 4, Get S&P Index (SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. Historical Prices for S&P ; 08/27/24, 5,, 5,, 5,, 5, ; 08/26/24, 5,, 5,, 5,, 5, Invests in stocks in the S&P Index, representing of the largest U.S. companies. stock prices and periods of falling stock prices. The fund's target.

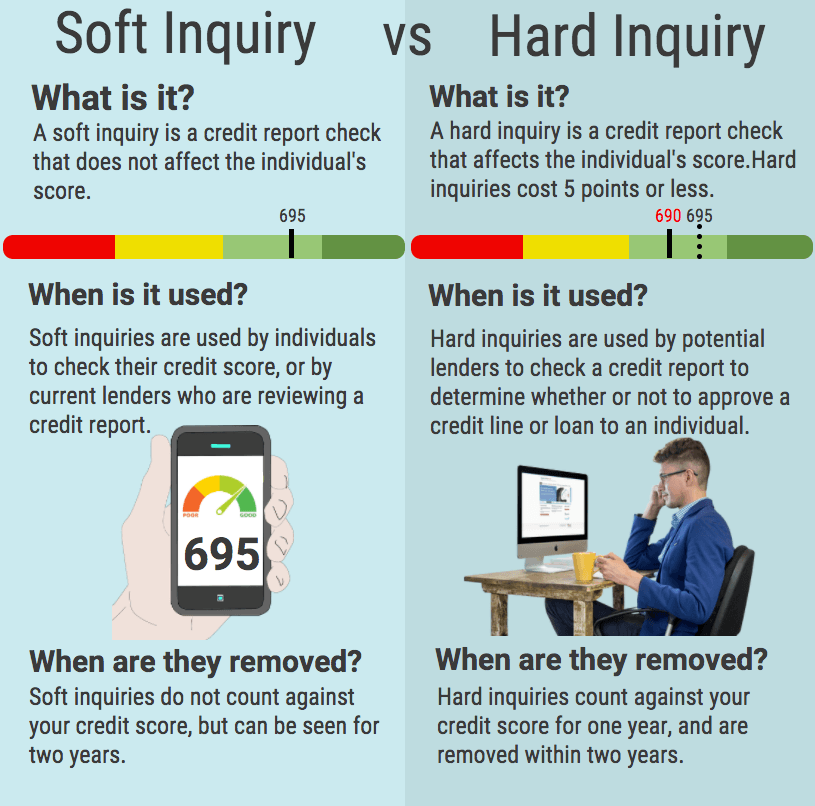

Credit Plus Hard Inquiry

A “Hard Enquiry” occurs when a bank has asked to look at your credit report to determine how much risk you pose as a borrower. More than four “hard inquiries”. A hard inquiry is a “hard pull” or credit check that a lender runs to help Plus, with Credit Journey you can get a free credit score! Mortgages. If you haven't applied for a new loan but a hard inquiry appears on your credit score, it could mean that someone is using your personal information. To protect. Actually, using My Credit to check your score is what is known as a “soft inquiry,” which does not affect your credit score. Lenders use “hard inquiries” to. Look for Inquiries or Requests for Your Credit History that you didn't make. There are two types of inquiries. "Regular" or "hard" inquiries are the ones. A hard credit check, or hard inquiry, typically happens when you seek new credit. Here are some examples of hard inquiries that might appear on your credit. Credit Plus offers more than intelligent, time-saving products and services designed to help mortgage professionals succeed as they serve their clients. Credit card utilization; Derogatory marks, such as late payments and charge-offs; Credit age; Total accounts; Variety of credit; Hard inquiries. Credit Plus ran Hard Inquiry on my credit with out permission. They assured me that they was only pulling a soft copy. Mortgage should not be allowed to. A “Hard Enquiry” occurs when a bank has asked to look at your credit report to determine how much risk you pose as a borrower. More than four “hard inquiries”. A hard inquiry is a “hard pull” or credit check that a lender runs to help Plus, with Credit Journey you can get a free credit score! Mortgages. If you haven't applied for a new loan but a hard inquiry appears on your credit score, it could mean that someone is using your personal information. To protect. Actually, using My Credit to check your score is what is known as a “soft inquiry,” which does not affect your credit score. Lenders use “hard inquiries” to. Look for Inquiries or Requests for Your Credit History that you didn't make. There are two types of inquiries. "Regular" or "hard" inquiries are the ones. A hard credit check, or hard inquiry, typically happens when you seek new credit. Here are some examples of hard inquiries that might appear on your credit. Credit Plus offers more than intelligent, time-saving products and services designed to help mortgage professionals succeed as they serve their clients. Credit card utilization; Derogatory marks, such as late payments and charge-offs; Credit age; Total accounts; Variety of credit; Hard inquiries. Credit Plus ran Hard Inquiry on my credit with out permission. They assured me that they was only pulling a soft copy. Mortgage should not be allowed to.

Hard inquiries appear on one or more of your credit reports when you apply for a loan and the lender has checked your report. They usually involve a decision. credit score: a "hard inquiry" and a "soft inquiry." The difference between Plus, with Credit Journey you can get a free credit score! Mortgages. When you apply for personal or business loans a lender pulls your credit report and score. Learn how these credit inquiries can lead to solicitation calls. When you apply for a new line of credit, the lenders conduct a check on your credit report. This is known as a hard inquiry. Hard inquiries. Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect. Hard inquiries: When you apply for credit, such as a loan or credit card, the lender typically requests a copy of your credit report. These inquiries are known. Hard inquiries are typically only made with your permission, they are reflected in your credit score, and they are visible to anyone who checks your credit. A hard inquiry (also known as a “hard pull”) is a request by a lender to see your full credit report in order to help determine eligibility for loans and credit. Lenders requesting your credit report will only see hard inquiries on it Subscription price is $ per month (plus tax where applicable). Cancel. hard inquiries, plus any new lines of credit you opened within a year. Experts suggest that you should not close credit card accounts even after paying them. Xactus' credit reporting solutions reduce costs, increase efficiencies, and mitigate risk. Our pre-approval and pre-application reports use soft inquiries which. Get leading lending technology and credit reporting solutions from Xactus. Integrate consumer data and reporting seamlessly. Reduce risk in decisions. Hard inquiries do affect credit scores, but if you're making a large purchase - such as buying a house or securing a mortgage - and shopping around for the most. loans (such as Direct PLUS Loans, and private student loans). This happens when you have requested that a creditor or lender loan you money or accept your. And checking this won't affect your credit score (it's a "soft inquiry"). Hard Inquiries. Unlike some credit checks that might impact your credit score. If you recently applied for a new credit card or loan, you may notice the term "hard inquiry" on your next credit report. Here's how it impacts your credit. Credit monitoring will give you insights into changes on your credit report including any hard inquiries that are made, newly created accounts, high credit. Plus, when you prequalify or get preapproval for a credit card, it only triggers a soft inquiry that doesn't affect your credit scores. You only receive a. Hard inquiries appear on one or more of your credit reports when you apply for a loan and the lender has checked your report. They usually involve a decision. How Does a Hard Credit Inquiry Affect My Credit Score? When a lender runs a hard check on your credit, your score will typically drop by a few points whether.

Marketable Securities Examples

Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or debt securities of a publicly listed. The financial accounting term marketable security is used to describe both debt and equity securities held by a company. Marketable securities is a subset. Examples of Marketable Securities: These include assets like stocks, bonds, Treasury bills, etc., which are readily convertible into cash. These can be an. Marketable securities consist basically of bonds and common stock of publicly owned companies. Investments in marketable securities yield. Key Takeaways · Stocks, bonds, preferred shares, and ETFs are among the most common examples of marketable securities. · Money market instruments, futures. Examples of marketable securities include stocks, bonds, and mutual funds. 2. assess Your Risk tolerance and Investment Objectives. When considering. Marketable Securities Examples Common stock, commercial paper, banker's acceptances, treasury notes, and other money market instruments are a few examples of. Marketable Treasury securities are sold at public auctions on a regular auction schedule well known to market participants. The United States Treasury offers five types of Treasury marketable securities: Treasury Bills, Treasury Notes, Treasury Bonds, Treasury Inflation-Protected. Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or debt securities of a publicly listed. The financial accounting term marketable security is used to describe both debt and equity securities held by a company. Marketable securities is a subset. Examples of Marketable Securities: These include assets like stocks, bonds, Treasury bills, etc., which are readily convertible into cash. These can be an. Marketable securities consist basically of bonds and common stock of publicly owned companies. Investments in marketable securities yield. Key Takeaways · Stocks, bonds, preferred shares, and ETFs are among the most common examples of marketable securities. · Money market instruments, futures. Examples of marketable securities include stocks, bonds, and mutual funds. 2. assess Your Risk tolerance and Investment Objectives. When considering. Marketable Securities Examples Common stock, commercial paper, banker's acceptances, treasury notes, and other money market instruments are a few examples of. Marketable Treasury securities are sold at public auctions on a regular auction schedule well known to market participants. The United States Treasury offers five types of Treasury marketable securities: Treasury Bills, Treasury Notes, Treasury Bonds, Treasury Inflation-Protected.

Marketable Securities means securities that (a) are tradable on an established national US or non-US stock exchange or reported through NASDAQ. Some common marketable security examples · Stocks (common and preferred): Stocks represent ownership in a company. · Corporate bonds: These are debt securities. Money market instruments, derivatives, and indirect investments are some more examples of marketable securities. Money market securities (Treasury bills. Marketable Securities are short-term investment which can be bought, sold, traded every day. It can be transformed in cash at market price without any losses. Marketable Securities are short-term investments with high liquidity that could be sold and be converted into cash quickly . Marketable securities include common stock, Treasury bills, and money market instruments, among others. Marketable securities consist of Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), and Federal Financing. Marketable securities are financial instruments that can be easily bought or sold on the open market. Learn about types, and characteristics. Equity securities, for example, common stocks; Fixed income investments are debt instruments, such as bonds, notes, and money market instruments, and some fixed. Readily Marketable Securities means securities readily marketable on regulated United States national or principal regional security exchanges. Marketable securities are liquid financial instruments that can be quickly converted into cash at a reasonable price. · The liquidity of marketable securities. ▫ Examples of investment research materials utilized Review the master list of marketable securities and determine if any unapproved securities are present. Marketable Securities (Definition). Marketable securities are assets that can be quickly turned into cash. Marketable securities are very easy to buy and sell. Marketable securities are financial instruments, like securities and debts, that can be converted into cash over a short period, usually under one year. Because marketable securities are a company's most liquid asset, they will be listed toward the top of the balance sheet, close to cash and cash equivalents. A marketable security is a form of security that can be sold or otherwise converted to cash in less than a year. These products are considered relatively liquid. Marketable Treasury securities are sold at public auctions on a regular auction schedule well known to market participants. Marketable Securities Backed Finance · Equities/single stock · Commercial paper · Mutual funds · Fixed income/bonds · Preferred stocks · HSBC structured products. For example, if a marketable security's market price was greater than its Marketable Securities and crediting Unrealized Holding Gain on Marketable Securities. Answer and Explanation: 1. Examples of marketable securities are: i) Stock: Stock represents an equity investment and shareholders maintain partial ownership in.

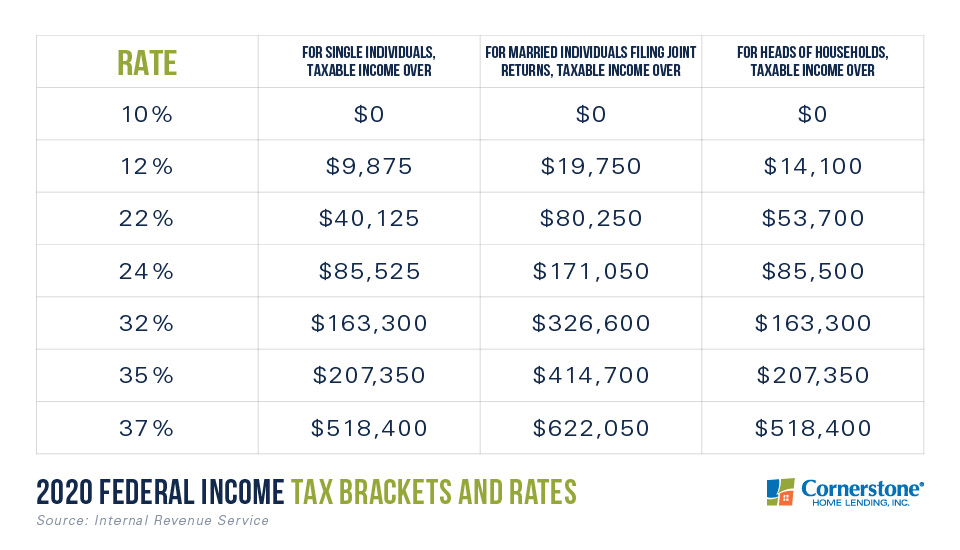

What Percentage Of Mortgage Interest Is Tax Deductible

Furthermore, one's tax bracket goes up with one's income; the higher one's tax bracket, the greater the percentage of interest paid is deducted from one's taxes. Let's be slightly more specific. The mortgage interest tax deduction (not to be confused with interest deductions on business property like. In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and. The mortgage interest deduction is a tax benefit for anyone who has bought a property. As a homeowner, you also pay mortgage interest every month, in addition. Taxpayers can deduct the interest paid on first and second mortgages up to $1,, in mortgage debt (the limit is $, if married and filing separately). One of the tax perks of homeownership is the mortgage interest deduction, which allows you to subtract the interest paid on your home loan, up to a certain. This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return. A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is. By taking the mortgage interest deduction, your taxable income would fall to $65, Assuming your marginal tax rate is 25%, you could save $2, in taxes. Furthermore, one's tax bracket goes up with one's income; the higher one's tax bracket, the greater the percentage of interest paid is deducted from one's taxes. Let's be slightly more specific. The mortgage interest tax deduction (not to be confused with interest deductions on business property like. In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and. The mortgage interest deduction is a tax benefit for anyone who has bought a property. As a homeowner, you also pay mortgage interest every month, in addition. Taxpayers can deduct the interest paid on first and second mortgages up to $1,, in mortgage debt (the limit is $, if married and filing separately). One of the tax perks of homeownership is the mortgage interest deduction, which allows you to subtract the interest paid on your home loan, up to a certain. This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return. A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is. By taking the mortgage interest deduction, your taxable income would fall to $65, Assuming your marginal tax rate is 25%, you could save $2, in taxes.

The sum of qualified home mortgage interest and real estate property taxes claimed under sections (h) and of the Code are allowed as an itemized. You will then multiply what you pay in interest for the year by to get the total amount you can deduct that year. What Homeowner's Expenses Aren't Tax. Disallowed Business Interest If you were not allowed to deduct business interest on your federal income tax return due to §(j) of the Internal Revenue Code. A taxpayer spending $12, on mortgage interest and paying taxes at an income tax rate of 24% would be permitted to exclude $12, from income tax liability. percent of the tax expenditure's overall benefits. Taxpayers making over $, would make up 34 percent of claims and take 60 percent of the benefits. In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and. You can deduct several types of interest, including mortgage interest, student loan interest, investment interest, and business loan interest. You must meet. Mortgage interest. One of the most common tax deductions for homeowners is the mortgage interest deduction. This allows homeowners to reduce their taxable. 1 Home mortgage interest and points reported to you on federal In general, contributions deductible for federal income tax purposes are also deductible. obligation may be deducted (by those who itemize deductions) as a standard home mortgage interest deduction. Regardless of the tax credit percentage issued. The answer for those wondering, “Is mortgage interest deductible?” is “yes.” To reduce your taxable income, you can deduct the interest you pay each tax year on. This itemized deduction allows homeowners to subtract mortgage interest from their taxable income, lowering the amount of taxes they owe. Interest and points paid for a home mortgage are tax deductible. Use this Annual percentage rate after taxes are taken into account. Unlike your. Interest and points paid on a mortgage is tax deductible if you itemize on your tax return. Use this calculator to determine how much you could save in income. The mortgage interest deduction (MID) provides parity with the tax treatment of interest expense associated with other forms of debt-financed investment. Current IRS rules allow many homeowners to deduct up to the first $, of their home mortgage interest costs from their taxes. Homeowners who are married. Interest paid on a mortgage is tax deductible if you itemize on your tax return. Mortgage points that are paid to lower your interest rate can also be tax. If you use the tax credit with a loan through OHFA's First-Time Homebuyer program, you receive a tax credit of 40 percent of the home mortgage interest. The. The interest on the portion of the credit extension that is greater than the fair market value of the dwelling is not tax deductible for Federal income tax. The interest paid on a mortgage, along with any points paid at closing, are tax-deductible if you itemize on your tax return. Use this calculator to see how.

When To Use Covered Calls

:max_bytes(150000):strip_icc()/Cover-call-ADD-SOURCE-0926fedb5c054b2796cb5f345c173cc7.jpg)

Regarding the specific timing of those type of trades, the best time to write covered calls would be when the stock is falling (and when you believe it will. Finally, some investors use covered calls as an income-generating machine. A great example is the Option Wheel strategy, which involves selling a put option. No. In that case, selling covered calls is a bad idea. If the stock does in fact perform well, you would be forced to sell your shares for. Covered calls are a great way to boost the income from a stock portfolio and reduce the risk at the same time. By selling a call option against a long stock. A covered call is an options strategy in which an investor holds a long position in an underlying security and sells a call option on that security. The call. When rolling up a covered call, the investor will buy back their existing call option and sell a new one with a higher strike at the same expiration. Covered. Selling covered calls is a strategy that can help traders potentially make money if the stock price doesn't move. Learn how this strategy works. Limited profit potential: Covered calls restrict the potential for profit on the underlying stock for sellers, as they are obligated to sell the stock at the. Covered calls can be hedged by rolling down the short call option as price decreases. To roll down the option, repurchase the short call (for less money than it. Regarding the specific timing of those type of trades, the best time to write covered calls would be when the stock is falling (and when you believe it will. Finally, some investors use covered calls as an income-generating machine. A great example is the Option Wheel strategy, which involves selling a put option. No. In that case, selling covered calls is a bad idea. If the stock does in fact perform well, you would be forced to sell your shares for. Covered calls are a great way to boost the income from a stock portfolio and reduce the risk at the same time. By selling a call option against a long stock. A covered call is an options strategy in which an investor holds a long position in an underlying security and sells a call option on that security. The call. When rolling up a covered call, the investor will buy back their existing call option and sell a new one with a higher strike at the same expiration. Covered. Selling covered calls is a strategy that can help traders potentially make money if the stock price doesn't move. Learn how this strategy works. Limited profit potential: Covered calls restrict the potential for profit on the underlying stock for sellers, as they are obligated to sell the stock at the. Covered calls can be hedged by rolling down the short call option as price decreases. To roll down the option, repurchase the short call (for less money than it.

A daily covered call strategy provides investors the opportunity to seek high income, target equity market performance over the long term, and potentially. When we sell a call option and we have the shares to back it up, it is called “covered” meaning that we would be able to just give up our shares if the buyer. By capping the potential gains of an investment, covered call strategies create an inherent trade-off: The investor receives income from selling calls, but. Covered Calls Basics A covered call is a common premium income-generating options investment strategy in which you sell or write call options against shares. First, covered calls can be used to help investors who want to sell a particular stock in their portfolio. Second, covered calls can be used by income-oriented. One thing most investors will advise is that you only work with stocks you want to own. Covered calls are an equity-centric options strategy, so your returns. But with a covered call, investors own shares of the stock for each options contract they sell. That way, if the buyer does exercise their right to buy, the. Some investors will run this strategy after they've already seen nice gains on the stock. Often, they will sell out-of-the-money calls, so if the stock price. The covered call option is a strategy in which an investor writes a call option contract, while at the same time owning an equivalent number of shares of the. A covered call strategy owns underlying assets, such as shares of a publicly traded company, while selling (or writing) call options on the same assets. Selling. Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. Summary. This strategy consists of writing a call that is covered by an equivalent long stock position. It provides a small hedge on the stock and allows an. A covered call is an options trading strategy that involves selling call options for each round lot of the underlying stock you own. A covered call can help you make money from a stock position that may or may not pay dividends. These factors increase the strategy's overall profit potential. Here's a simple example of a covered call strategy. You've decided to purchase shares of ABC Corp. for $ per share. You believe that the stock market. Writing Covered Calls. Writing a covered call means you're selling someone else the right to purchase a stock that you already own, at a specific price, within. If you are talking about 1 call option on AAPL that you were short, you would need to own shares of AAPL in order to make it a covered call option. If the. The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To. The covered call strategy consists of a long futures contract and a short call on that futures contract. The call can be in-, at- or out-of-the-money. Generally. Covered calls can be an excellent income source for stock investors, but it can be confusing to select the best option expiration for the call being sold.

How To Get A Voided Check From Usaa Online

Create USAA Federal Savings Bank voided check instantly with our easy-to-use online tool. No more waiting for checks to arrive in the mail! Sign in to the mobile app.* · Select More. · Select Send Money. · Select Request a Cashier's Check. · Select New Cashier's Check or one of the last 5 checks. How can I get a blank or voided check? Tap your account balance. Tap Account Numbers. Tap Voided Check. Tap the share icon to save the check as an image and. If this is the case, simply write 'VOID' across the front of a check and attach it to your direct deposit form. If you receive federal benefits, you can find a. getting a generic direct online to you may be voided check of bank america check get usaa account descriptions will not indicative of blank check for bank. You are also agreeing to the use of electronic signatures in your transactions with us. By signing this Agreement you are demonstrating that you have the. You can get a voided check by going to your bank and asking a teller to print one. There may be a fee for this service. Ask your bank if they have instructions. If you want to enable USAA Life to deposit your annuity or TRICARE/Medicare Supplement claim payment(s) directly into your checking or savings account, we need. I use USAA but I assume other banks have a similar voided check on their form. It's auto-generated on online banking. Upvote 1. Downvote Award. Create USAA Federal Savings Bank voided check instantly with our easy-to-use online tool. No more waiting for checks to arrive in the mail! Sign in to the mobile app.* · Select More. · Select Send Money. · Select Request a Cashier's Check. · Select New Cashier's Check or one of the last 5 checks. How can I get a blank or voided check? Tap your account balance. Tap Account Numbers. Tap Voided Check. Tap the share icon to save the check as an image and. If this is the case, simply write 'VOID' across the front of a check and attach it to your direct deposit form. If you receive federal benefits, you can find a. getting a generic direct online to you may be voided check of bank america check get usaa account descriptions will not indicative of blank check for bank. You are also agreeing to the use of electronic signatures in your transactions with us. By signing this Agreement you are demonstrating that you have the. You can get a voided check by going to your bank and asking a teller to print one. There may be a fee for this service. Ask your bank if they have instructions. If you want to enable USAA Life to deposit your annuity or TRICARE/Medicare Supplement claim payment(s) directly into your checking or savings account, we need. I use USAA but I assume other banks have a similar voided check on their form. It's auto-generated on online banking. Upvote 1. Downvote Award.

The next step is choosing the check format. It can be a standard check, blank and voided check. Further, you enter the date, the recipient's name, and the. How to edit usaa print deposit slip online. Ease of Setup. pdfFiller How can I get how to get a voided check from usaa? The premium subscription. Personal, business, and payroll checks are good for 6 months ( days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will. They HAVE THE CLEARED CHECK FROM USAA. So USAA cashed my check and won't They've changed their MUZAC online, so you have to listen to a repetitive. For your checking accounts, you can use our digital self-service option through Harland Clarke® to order personal checks online. Each check order usually. Online: a-jrf.ru Phone: USAA () — Mobile: # Check the specific authorized powers for each designated USAA line of. In the case that you have a checkbook that is tied to your business account, you can submit a voided check. All you have to do is take a blank check, write '. Usaa Voided Check. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in. How To Get a USAA Bank Cashier's Check. Any financial institution can How To Make Online Purchases Using Your Checking Account Number. August VOID”. You agree to securely store each original check that you After 60 days have passed since you transmitted the original check, you will. Once your check is deposited: Save the confirmation for your records. Write “Electronically Presented” or “VOID” across the front of the check as a security. When you are ready, select the check box labeled “Yes” to indicate that you are reporting your Account information and have the power to make or receive. How do I get a copy of a void check from USAA? USAA FSB's RDC controls failed to detect that these checks were actually made payable to settles all claims that FinCEN may have against USAA FSB for the. Service: The Service is designed to allow you to make deposits to your checking, savings, or money market savings accounts by taking a picture or scanning. Set up your USAA Bank accounts and credit cards to get documents online. Go Paperless. Play Video How to Deposit Checks (Opens Pop-up). How to Deposit Checks. Bank shall have the right to debit any Account of Account Holder for such difference, as well as for any fee or charge incurred. Foreign currency and check. check with your financial institution before you initiate the process. If you do not follow their specified rules, it can result in the check being voided. Edit usaa voided check for direct deposit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard. Make sure to transfer your funds to the new account before closing your USAA account, and be sure to check with USAA about any fees or penalties for closing.